TRADINGVIEW IS LOOKING FOR A NEW INDIAN REGION MODERATOR!Join Our Team: Exciting Opportunity to Become a Moderator for the Indian Region Community at TradingView!

Hello TradingView Enthusiasts,

Are you passionate about trading and the TradingView platform? We are on the lookout for a new moderator to join our INDIAN REGION Community and help elevate th

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

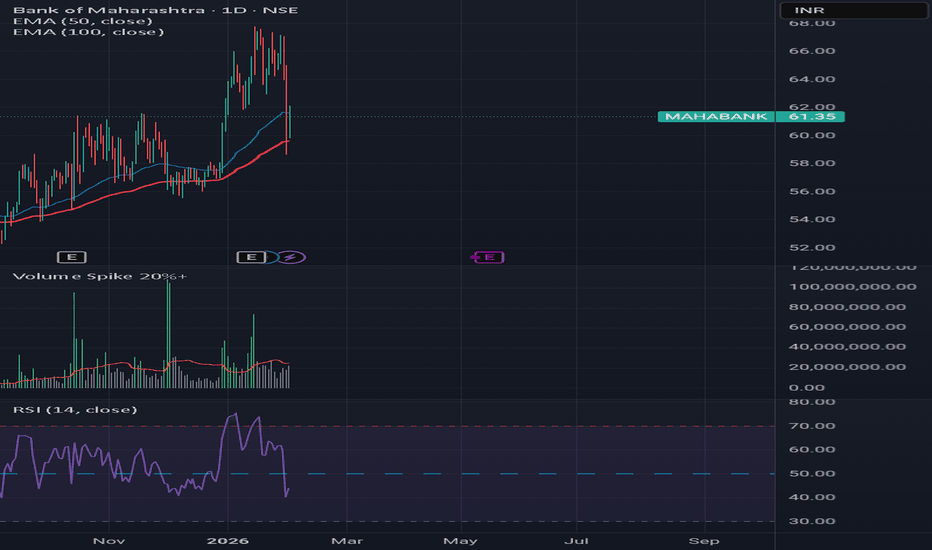

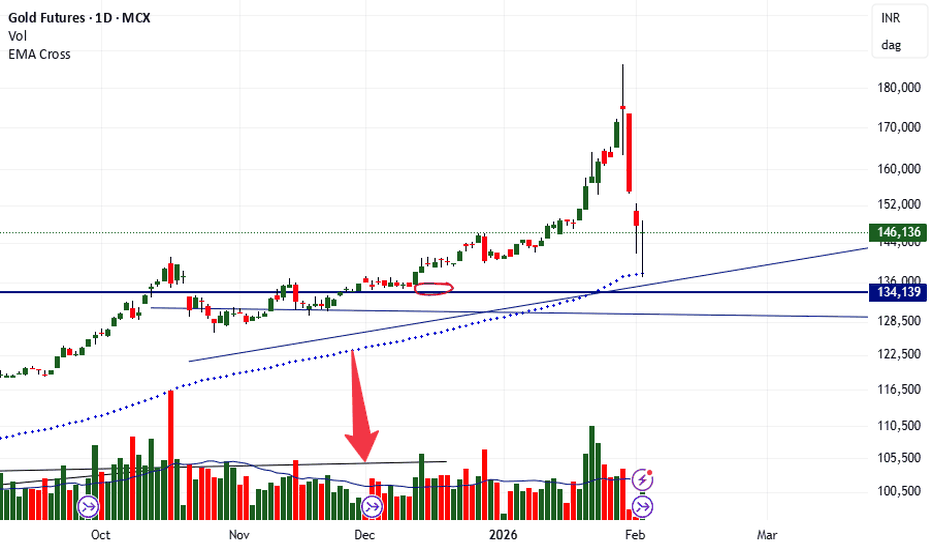

Market Outlook & Trade Setup – Monday, 2nd Feb 2026Major indices corrected heavily yesterday during the Budget announcement due to the increase in STT in F&O and no respite in LTCG.

Nifty, Sensex and Bank nifty went minus by almost 500,1200 and 1500 points respectively. We expect the selling to continue further. Additionally, the selling in metals c

PTL Trade SetupCurrent Market Price (CMP): 41.50

Breakout Context: Consolidation breakout confirmed yesterday with strong volume, which adds conviction.

Target: 46.62 (approx. +12.3% from CMP)

Stop Loss: 40.03 (risk of about -3.5% from CMP)

Key Notes

- A breakout with volume often signals genuine momentum, but

KAYNES above 3427 – Breakout or Pullback?KAYNES Technology India has strong long-term earnings growth and good profit and revenue growth over recent years, supported by expanding electronics & EMS market trends.

The stock trades with a relatively high P/E but is backed by a firm order book and industry relevance.

Despite recent volatility

Expecting audcad sell delivery for buy setupsBetween these two red lines inside weekly+daily imb, the set-up could be find for buys

Why? Price already taken the liquidity above and it possible scenario

shows the probability

of retracement ( where structure shift indicates sellside delivery,

however buys will be

more safer approach fundam

PAGEIND M PATTREN BREAKDOWN 31 01 2026📈 1) Pageind Pattern Structure: M-Pattern / Double Top

An M-Pattern (Double Top) is a bearish reversal pattern with the following components:

Left Top → Right Top ≈ equal highs

Neckline → horizontal support connecting the swing lows between tops

Breakdown → close below the neckline confirms the pat

BSE-Likely Cup &Handle Break outBSE:

Trading at 2881 and above all its critical Moving averages Viz10/20/50/10 DEMA

In daily chart has formed C&H Pattern,

Based on the pattern and price volume suggests -breaking the Neckline resistance at 2880-2900 likely to test 2950/3000+ shortly(For educational purpose only)

JINDALSTELJINDALSTEL

bullish trend is Showing on the chart.

buy signals in

technical indicators and

cup with handle & ascending triangle chart pattern.

BUYING RANGE 1090/1100

Watch for a breakout above 1090/1100 to sustain the bullish trend. If the resistance holds, there could be a retest towards 975/980

FUSION - Time to shine?DISCLAIMER: This is NOT a trade recommendation but only my observation. Please do your own analysis before entering your trades

Points to note:

-----------------

1. Price has been in consolidation for 8 months inside a triangle

2. Attempt to breakdown was rejected with price swiftly moving back i

See all editors' picks ideas

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

See all indicators and strategies

Community trends

PTL Trade SetupCurrent Market Price (CMP): 41.50

Breakout Context: Consolidation breakout confirmed yesterday with strong volume, which adds conviction.

Target: 46.62 (approx. +12.3% from CMP)

Stop Loss: 40.03 (risk of about -3.5% from CMP)

Key Notes

- A breakout with volume often signals genuine momentum, but

MCX NSE/BSE(STOCK) EQUITY, GREAT BUYING OPPROTUNITY."a great dip occurred, and i have been waiting eagerly to buy at this price following the stock split. this is an excellent opportunity to purchase and target a sale price between 3,000 and 3,110. if you are a long-term buyer, you can hold for three to four years and potentially see your investment

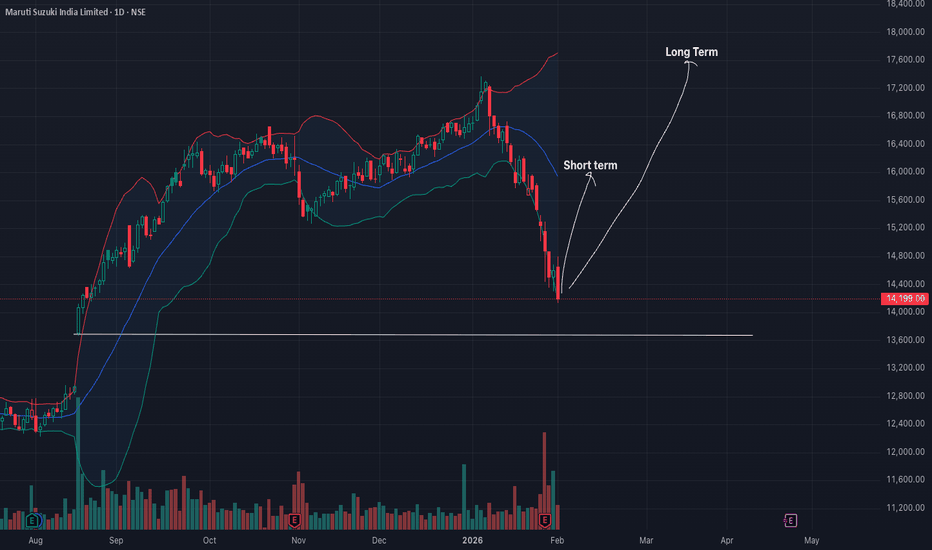

Maruti Suzuki: Gearing Up for a BreakoutMaruti Suzuki (MARUTI) is currently at a strategic inflection point, exhibiting a super bullish outlook as it transitions from a traditional ICE powerhouse to an EV contender. Fundamental strength is anchored by a record-breaking Q3 FY26, where net sales surged 29% YoY to ₹475 billion. The imminent

KAYNES above 3427 – Breakout or Pullback?KAYNES Technology India has strong long-term earnings growth and good profit and revenue growth over recent years, supported by expanding electronics & EMS market trends.

The stock trades with a relatively high P/E but is backed by a firm order book and industry relevance.

Despite recent volatility

BLUESTARCO – Pure Price Action in ActionBLUESTARCO was moving inside a falling channel for a long time, where price kept coming down from the upper trendline and taking support at the lower trendline, showing how clearly it respected the structure. Recently, price reached the lower support again and bounced strongly, which tells us that s

Positional or Longterm Opportunity in NAVA LtdGo Long @ 570.9 for Targets of 607.25, 643.6, 679.95 and 716.3 with SL 534.55

Reasons to go Long :

1. The stock formed a Bullish Engulfing Pattern (marked with a orange color).

2. Also there is a strong Trendline (marked with green color) which supports the stock.

3. Also there is a strong deman

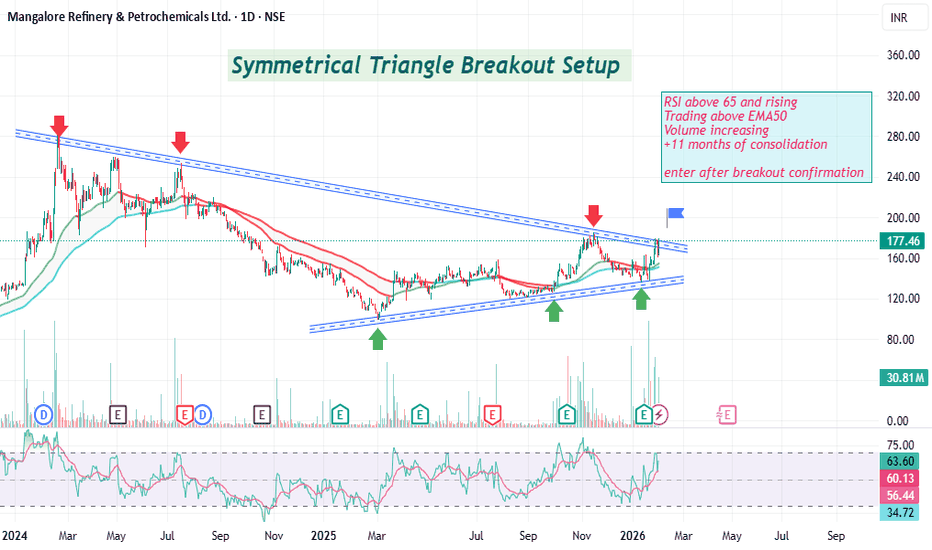

Symmetrical Triangle Masterpiece : Multi-Layout W,DtfStep into this dynamic multi-layout window opened right in front of you—a split-screen showcase of pure price action artistry.

Left Side: Weekly Timeframe

Here, a symmetrical triangle (a classic continuation or reversal pattern formed by two converging trendlines of equal slope) takes center stage.

See all stocks ideas

Today

ALKYLAMINEAlkyl Amines Chemicals Limited

Actual

—

Estimate

8.65

INR

Today

ZYDUSWELLZydus Wellness Limited

Actual

—

Estimate

0.30

INR

Today

SIGNATURESignatureglobal (India) Limited

Actual

—

Estimate

—

Today

AETHERAether Industries Ltd.

Actual

—

Estimate

4.10

INR

Today

SOLARINDSSolar Industries India Limited

Actual

—

Estimate

49.16

INR

Today

RBARestaurant Brands Asia Limited

Actual

—

Estimate

−0.40

INR

Today

AGARWALEYEDr. Agarwal's Health Care Ltd.

Actual

—

Estimate

1.00

INR

Today

GABRIELGabriel India Limited

Actual

—

Estimate

—

See more events

Community trends

ETHUSD SHOWING A GOOD DOWN MOVE WITH 1:8 RISK REWARDETHUSD SHOWING A GOOD DOWN MOVE WITH 1:8 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the market

which preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the mark

Why Bitcoin’s Stability Is a Warning, Not StrengthBitcoin’s inability to participate in the recent “debasement trade” is not a sign of hidden strength — it’s a sign of waning relevance in the current macro cycle.

While gold and silver surged during the final euphoric phase, Bitcoin’s stagnation near $82,000 suggests that capital actively chose har

Bitcoin Bybit chart analysis FEBURARY 2Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

The Nasdaq indicators will be released shortly at 12:0

#ETH Risker than beforeWatch for these levels. ETH can head back to $900 to $1000 again.

This chart/indicator is provided for educational and informational purposes only.

It does not constitute financial advice, investment recommendations, or trade signals.

The creator and Systematic Traders Club are not responsible

$BTC UPDATE: 22% DOWN FROM MY SHORT ZONECRYPTOCAP:BTC UPDATE: 22% DOWN FROM MY SHORT ZONE

When Most MoonBoys Were Calling $200K–$500K... I Shared Shorts at $95K-$98K.

Today: Bitcoin Touched $75,500 ✅

Results Without Leverage: +22%

With 5x Leverage: ~100%+ ProfitIf You Followed the Setup and Now Time to Book Profits.

The Trend Was Clear

See all crypto ideas

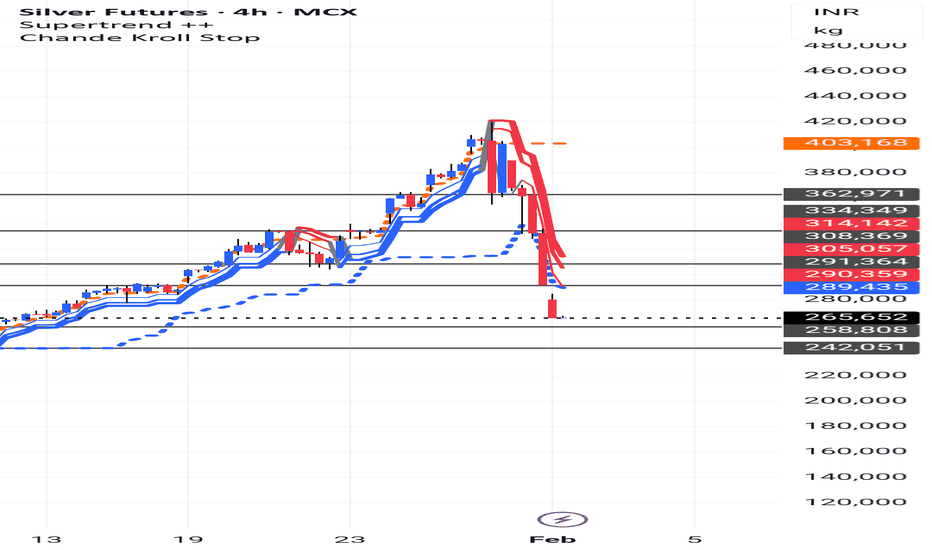

$TVC:SILVER MOON MISSION:2025-29 is History Repeating Again? TP?🚀 Silver Feature Analysis 2026 – 2029: The Historical Repeat 🚀

TVC:SILVER has recently hit its All-Time High (ATH) three times in history with massive rallies. My analysis is based on the duration and percentage returns of these specific periods:

1️⃣ 1980: (1 Aug 1979 to 29 Jan 1980) – A 6-month

Silver Weekly Outlook: Post-Exhaustion PhaseSilver has entered a high-volatility post-exhaustion phase after a sharp parabolic rise followed by an equally aggressive correction. The weekly chart clearly shows that price moved too far, too fast, and the recent sell-off is a classic example of mean reversion after euphoric buying. Such phases r

GIFTNIFTY Intra-Swing Level Analysis for 02nd FEB 2026 GIFTNIFTY Intra-Swing Level Analysis for 02nd FEB 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

━━━━━━━━━₹₹₹₹₹₹₹₹₹₹₹₹━━━━━━━━

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility

XAGUSD/SILVER WEEKLY SELL PROJECTION 01.02.26XAGUSD Weekly Sell Projection – Script

This is the weekly technical analysis of XAGUSD, also known as Silver.

Price was previously moving inside a parallel uptrend channel.

Near the top of the channel, the market formed an Evening Star candlestick pattern, which indicates a potential bearish rever

SILVER CRASH >>> What next ?Silver

ATH 422K

Sharp Correction/Dip CMP 265k

View

Gap is highlighted via 3 Yellow Circles

CMP 265K is close to Final Gap

Further Dip till 250K or Max 245K is expected

Reversal from 245K cant be ruled out

Max 240K can be considered as SL

For more insights & trade ideas,

📲 Visit my profile

Crude Oil: The Market Is Revisiting the Scene of the BreakdownCrude Oil is revisiting a level where a major structural breakdown occurred in the past.

Markets don’t forget such zones easily. What once triggered aggressive selling often turns into active supply when revisited.

The recent move is not random strength — it’s a retest of prior imbalance, followed

XAUUSD: Liquidity Swap Near PDL – Relief Bounce Into Sell ZoneDescription

Gold is currently trading inside a key liquidity zone after a strong bearish impulse.

Price swept sell-side liquidity and is now showing a short-term corrective bounce.

What I’m seeing:

Clear bearish market structure (lower highs & lower lows)

Price reacting from sell-side liquidity

See all futures ideas

EURUSD - 4H - SHORTFOREXCOM:EURUSD

Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. wait for more Smart Money to develop before taking any pos

EURUSD - WEEKLY OUTLOOKOn the Monthly & Weekly timeframes, EURUSD remains bearish.

Price is currently holding in the premium area and has printed a strong weekly rejection candle from a monthly Order Block, which supports downside continuation.

🔍 Daily Perspective

Expectation is for price to move into the discount area,

Expecting EurCHF bearish Why should we trust this idea 💡??Eur has 2.15% interest rate ,while chf is safe heaven currency so

it would shows always significant strength towards chf ,apart from that any Ongoing panic

global events will also cause CHF bullish with aligning the price action parameters by following liquidity 💲⚔

EUR/USDEURUSD experienced a clean intraday sell-side liquidity sweep, breaking below the prior range low with strong bearish displacement, signaling a stop-driven move rather than organic trend continuation.

Price tagged the lower liquidity pool, printed a sharp rejection wick, and immediately delivered a

EUR/JPY Long: Riding the Momentum After Clean BOS The price action on EUR/JPY is currently displaying strong bullish momentum on the M15 timeframe. After a period of consolidation, the pair has successfully achieved a Break of Structure (BOS) to the upside, signaling a transition from a range-bound environment to an active uptrend.

AUDJPY : Bulls Defending the Line 106.60 !AUDJPY has undergone a significant correction, sliding from the 109.00 peak down to the 106.20 region. However, the bears have hit a massive roadblock. We are currently seeing a strong reaction from a historical demand zone (105.80 – 106.00), marked by the clear rejections in the shaded circles on t

See all forex ideas

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.