COFORGE – Weekly Chart | Clean Technical ViewNSE:COFORGE

🔹 Trendline + 50 EMA Support:

Price has pulled back into a rising weekly trendline, and the 50 EMA is sitting right there. This confluence is the key zone.

🔹 Price Action:

Rejection from 1950–2000 came with a controlled pullback, not panic selling. That tells me distribution isn’

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

SRF LTD: Price Compression at Key Resistance|Clean Breakout Play📌 Structure: Daily Timeframe

SRF has been consolidating inside a clean descending channel, printing lower highs while demand holds near the channel base.

Price is now pressing against well-tested channel resistance — a clear decision zone.

🔴 Key Reads

Descending resistance respected multiple times

NAUKRI – Tight Range, Clear Structure, Price Under CompressionPrice has been moving inside a well-defined converging range, with lower highs pressing from the top and higher lows holding from the bottom.

Each rejection from the upper line and each response from the lower line shows that both buyers and sellers are active, but volatility is gradually compressin

SAIL - Weekly - LongThis is a weekly chart of the SAIL, so it is useful for positional or swing trading.

First, let’s understand the trend based on the markings.

Earlier on the left side, the stock was making lower highs and lower lows, which clearly shows a downtrend. This phase is marked with “lower low” arrows. Aft

NBCC (India) Ltd | Weekly Consolidation Breakout SetupNBCC is showing a constructive weekly structure after a healthy pullback.

Price is holding above key moving averages

Higher lows indicate trend continuation

Tight consolidation near resistance suggests accumulation

Setup favors a range breakout on strength

Trade View:

Buy on strength above ₹125

Su

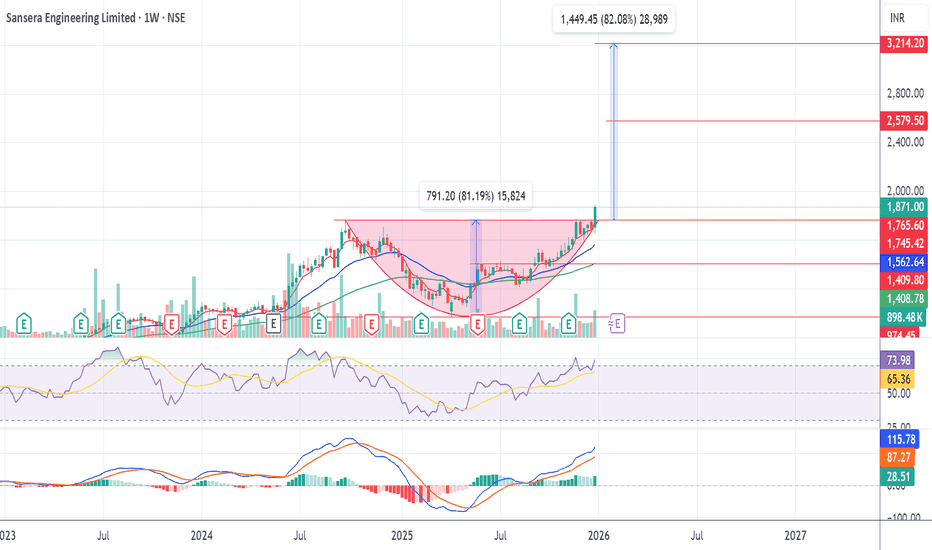

SANSERA ENGG@1871Not a SEBI registered, just sharing idea. On weekly time frame SANSERA @1871 gave breakout from rounding bottom @1767 with volume. Entry can be made 1871 and @1767, SL-1700 Target 1-2600 in 2-3 month, 2-3300 in 5-6 month. It is in Bull trend RSI on DAILY, WEEKLY >70 and MONTHLY>=70.

Crompton Greaves Falling?Technical (upgrade)

Crompton Greaves Consumer Electricals has been sliding inside a falling wedge, but price is trying to base around ₹248-252 (teal support on your chart). A daily close above ~₹260–262 (wedge top/near-term trendline) would confirm a breakout and set up a move toward ₹275 first an

BHEL – Weekly Trendline Still in ControlBHEL continues to trade in a strong uptrend on the weekly timeframe, with price respecting the rising trendline and closing near the recent highs around ₹299.50. The series of higher highs and higher lows remains intact, and the latest bullish weekly candle reinforces the strength of buyers along th

Crompton Greaves Cmp 252 Reversed from supportCrompton Greaves Cmp 252 dated 2-1-2025

1. Rectangle Consolidation

2. Price reversal from support

3. Price increase with Volumes

4. RSI reversal

5. Good Risk Reward Ratio

Buy above 254 SL 245 target 256-258-260-262-265

268-270-272-275-280

It is just a view, please trade at your own risk.

See all editors' picks ideas

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

Trend Line Methods (TLM)Trend Line Methods (TLM)

Overview

Trend Line Methods (TLM) is a visual study designed to help traders explore trend structure using two complementary, auto-drawn trend channels. The script focuses on how price interacts with rising or falling boundaries over time. It does not generate trade sign

Breakouts & Pullbacks [Trendoscope®]🎲 Breakouts & Pullbacks - All-Time High Breakout Analyzer

Probability-Based Post-Breakout Behavior Statistics | Real-Time Pullback & Runup Tracker

A professional-grade Pine Script v6 indicator designed specifically for analyzing the historical and real-time behavior of price after strong All-Ti

See all indicators and strategies

Community trends

COFORGE – Weekly Chart | Clean Technical ViewNSE:COFORGE

🔹 Trendline + 50 EMA Support:

Price has pulled back into a rising weekly trendline, and the 50 EMA is sitting right there. This confluence is the key zone.

🔹 Price Action:

Rejection from 1950–2000 came with a controlled pullback, not panic selling. That tells me distribution isn’

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that

ITC: Bounce Possible, Confirmation RequiredThe ongoing decline can be interpreted as a double zigzag (W–X–Y) , with Wave Y approaching a 100% projection of Wave W measured from X , placing price in a potential exhaustion zone . Price is also hovering near a key weekly pivot around 336–340 , an area that has previously acted as demand.

T

NAUKRI – Tight Range, Clear Structure, Price Under CompressionPrice has been moving inside a well-defined converging range, with lower highs pressing from the top and higher lows holding from the bottom.

Each rejection from the upper line and each response from the lower line shows that both buyers and sellers are active, but volatility is gradually compressin

The Elegance of Structure: Broadening Pattern, Breakout & EqSimplest Chart explanation ( no predications - using older than 3 months charts data only )

From 2012 to 2021, the price action formed a broadening structure defined by two converging white lines — a decade-long pattern showcasing expansion and volatility.

After a clean breakout and retest, the s

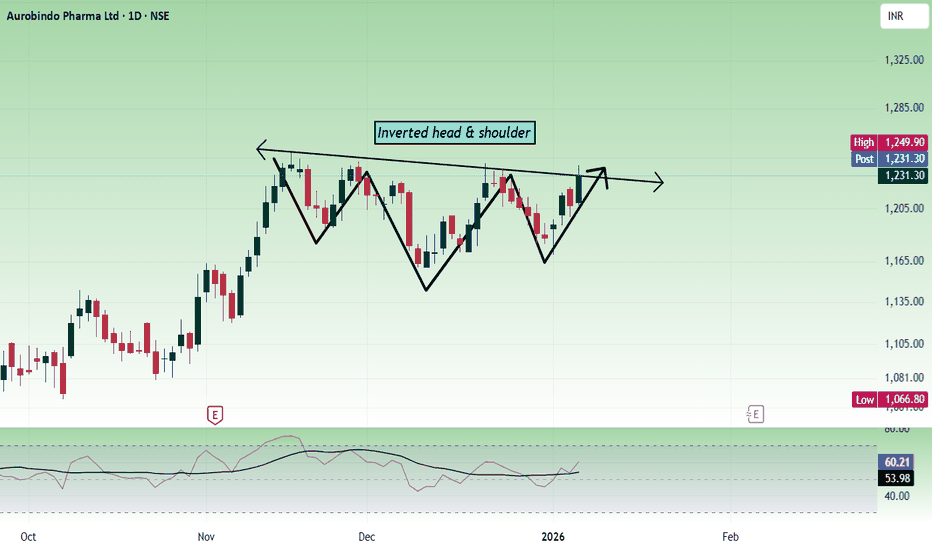

Auropharma at crucial levelAs per the daily chart, the price is forming an inverted head and shoulder pattern. The price should sustain the zone 1250 - 1260 to move up. Today's movement shows, the bulls have the strength to give a movement.

If the price opens above 1230 and shows bullish strength, buy above 1236 with the stop

TORNTPHARM: Pole & Flag Breakout After 6-Month ConsolidationAfter a strong uptrend (pole), TORNTPHARM consolidated in a flag pattern for nearly 6 months. The stock has now broken out above the flag resistance with strong momentum.

📊 Pattern: Pole and Flag (Monthly Chart)

⏳ Consolidation: ~6 months

✅ Status: Breakout confirmed

🎯 Outlook: Bullish continuation

SRF LTD: Price Compression at Key Resistance|Clean Breakout Play📌 Structure: Daily Timeframe

SRF has been consolidating inside a clean descending channel, printing lower highs while demand holds near the channel base.

Price is now pressing against well-tested channel resistance — a clear decision zone.

🔴 Key Reads

Descending resistance respected multiple times

[b]M&M (Mahindra & Mahindra) — Elliott Wave + Price Action View

Timeframe: 1H | Structure-based analysis

Market Structure Overview:

M&M has completed a clear Change of Character (CHoCH) near the bottom, followed by a strong impulsive move from the Golden Retracement Zone (50–78% of Wave A). This confirms a trend reversal and impulsive Wave 3 development.

See all stocks ideas

Tomorrow

IREDAIndian Renewable Energy Development Agency Ltd.

Actual

—

Estimate

—

Tomorrow

TEJASNETTejas Networks Ltd.

Actual

—

Estimate

—

Tomorrow

GLOBUSSPRGlobus Spirits Limited

Actual

—

Estimate

10.40

INR

Jan 10

DMARTAvenue Supermarts Ltd.

Actual

—

Estimate

11.74

INR

Jan 12

TCSTata Consultancy Services Limited

Actual

—

Estimate

35.97

INR

Jan 12

ANANDRATHIAnand Rathi Wealth Ltd.

Actual

—

Estimate

—

Jan 12

HCLTECHHCL Technologies Limited

Actual

—

Estimate

17.46

INR

Jan 12

GTPLGTPL Hathway Ltd

Actual

—

Estimate

—

See more events

Community trends

$TRX PRICE FORECAST | IS $5 POSSIBLE? | ANALYSIS BY CRYPTOPATELCRYPTOCAP:TRX PRICE FORECAST | IS $5 POSSIBLE? | ANALYSIS BY CRYPTOPATEL

#TRX Is Quietly Building A Massive Multi-Year Base On The 2W Chart.

Price Has Respected The Same Rising HTF Trendline Since 2020 — A Clear Sign Of Long-Term Strength.

Technical Highlights:

✅ Clean Higher Highs & Higher Lows

BTCUSD 1H Structure Shift Signals Bullish Continuation AheadBTCUSD 1H displays a clear intraday trend transition based on price action. Initially, price respected a bearish structure with lower highs and lower lows. A strong bullish displacement above prior structure confirmed a Change of Character , indicating a shift in order flow.

After the CHoCH, the m

Bitcoin Bybit chart analysis JENUARY 8Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

The Nasdaq indicator will be released shortly at 10:30

#ETH.P Guns loaded and ready for the big battleThe ETH is turning around after a good consolidation zone. After erasing the 2025 gain, the ETH is not set for running the next major cycle with the support from the whales. This cycle will be huge for ETH. Are you in the game already?

Disclaimer:

It does not constitute financial advice, investme

BTC/USD Daily Chart – Bullish Recovery Above Rising TrendlineOverall Structure

Bitcoin is in a recovery phase following a sharp decline from the previous highs.

Price is forming higher lows, suggesting buyers are regaining control in the short term.

The market remains below all-time highs, so this move is still considered a corrective rally within a larger

BTCUSDT Perpetual – Short Idea (FVG + Supply Rejection)BTC price faced rejection from a higher timeframe resistance zone and left a visible Fair Value Gap (FVG) above. Current structure shows consolidation below supply, increasing the probability of a downside continuation if the zone holds.

Trade Plan

🔻 Short Entry Zone: 93,300 – 93,500

🛑 Stop Loss:

Trend is your Friend !Bitcoin 4H Update (Jan 8, 2026) – 🇮🇳

Current price ~$91,003 (+0.34%). After multiple tests, BTC finally bounced from the key support zone ~$89,289–$90,600 (lower blue trendline + horizontal).

Key levels & observations:

- Support held strong at ~$89k–$90k (previous lows + channel bottom).

- R

Inverted Cup pattern Possible on BTCThe Inverted Cup and Handle is a bearish continuation pattern used in technical analysis. It is the mirror image of the classic "Cup and Handle" and signals that a stock or asset is likely to resume a downward trend after a brief period of consolidation.

Here is a breakdown of how to identify and t

$ZEC has already dropped ~21%, but the 372–380 zone stopped it CRYPTOCAP:ZEC has already dropped ~21%, but the 372–380 zone stepped in as a key demand area. As seen on the daily structure, price tapped this zone, found buyers, and managed a reaction bounce back toward 400. This confirms that the level is still being defended — for now.

However, this is not st

See all crypto ideas

NGAS (Natural Gas) – Technical Analysis | 2HFX:NGAS

Channel support line hit: Price has reacted exactly from the lower boundary of the falling channel, indicating structural support is respected.

New low not aggressive : The recent breakdown didn’t show strong momentum or expansion in range → signs of selling exhaustion, not panic.

De

Gold Structure Update – Bulls Still in Control next 4518++Hello everyone, gold is trading inside a clear rising channel, and the structure remains bullish with higher lows intact. After the recent upside move, price has pulled back toward the lower side of the channel, which is a normal and healthy move in a strong trend.

This pullback is happening exactl

Gold Trading Strategy for 08th January 2026🟡 GOLD (XAUUSD) – Intraday Trading Plan

📈 BUY SETUP (Bullish Scenario) 💰

🟢 Condition:

Buy ONLY IF price breaks and closes above the 1-hour candle HIGH

Confirmation level: Above 4478

🟢 Buy Entry:

📍 Buy above: $4478 (after 1H candle close above this level)

🎯 Buy Targets:

🥇 Target 1: $4490

🥈 Target 2:

“Bullish Pullback → Trendline Support Holding for Next Rally🔍 Key Technical Analysis

Price previously formed a strong bearish breakout, followed by a price rebound from a high pivot demand zone (POI) 🔄

Market has established a clear upward channel, confirming a medium-term bullish structure 📈

Break of Structure (BOS) to the upside signals a shift from bea

XAUUSD/GOLD 1H BULLISH ENGULFING BUY PROJECTION 07.01.26Falling Wedge pattern (Bullish Reversal) on XAUUSD – 1H timeframe.

Why this is a Falling Wedge 👇

Price is making lower highs and lower lows

Both trendlines are converging

Selling pressure is reducing

Pattern forms after an uptrend → healthy pullback

What it indicates 📈

Bullish reversal / cont

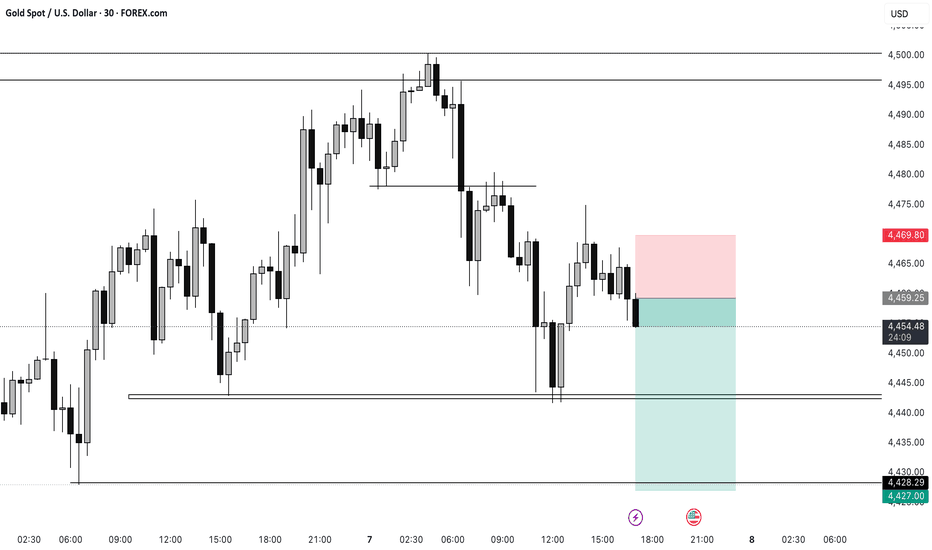

sell gold XAGUSDGold – Short-term Bearish Setup

Gold is bearish on the short time frame.

Sell below: current market price

Target: 4427.08

Stop-loss: 4469.53

Expected to hit the target within a few hours, if momentum continues.

Risk–Reward Snapshot

Risk: 4469.53 − entry

Reward: entry − 4427.08

If entry is near 4450,

GIFTNIFTY IntraSwing Levels For 09th JAN 2026❇️ GIFTNIFTY IntraSwing Levels for 09th JAN 2026

🚀Follow & Compare NIFTY spot Post for Taking Trade

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 &

Gold pauses; rotation, not continuation.🟡 XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (07/01)

📈 Market Context

Gold remains structurally bullish on higher timeframes, following a strong impulsive expansion that delivered price deep into premium. However, recent price action signals a transition from expansion into distributi

See all futures ideas

EURUSD – 15M | Liquidity Sweep → Demand Reaction →Mean ReversionPrice delivered a clean sell-side liquidity sweep into a higher-timeframe demand zone.

Displacement down exhausted, followed by acceptance and stabilization inside value.

Current structure suggests:

Sell-side taken ✔️

Price reacting from HTF demand ✔️

Expectation: mean reversion toward premium /

Gbpjpy Projecting in sellside delivery till weekly imbExpecting GBPJPY short term sell delivery,pric rejected from monthly Order block after taking previous monthly highs, expecting liquidity to take till weekly imbalance, onwards based on confirmation bullish move probably expected (the fundamental idea promotes buy from weekly imb where as GBP intere

USDJPY MULTI TIMEFRAME ANALYSIS Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions , the entry will be taken only if all rules of the strategies will be satisfied. wait for more price action to develop before taking any position. I suggest yo

EURUSD Buy Setup | Discount Zone Support + Trendline CompressionBias: Bullish

Timeframe: 1H

Pair: EURUSD

Trade Idea:

EURUSD is currently trading inside a discount zone, holding above a well-defined demand/support area. Price has respected this zone multiple times and is now showing compression against a descending trendline, indicating potential bullish expansi

USDJPY Sell TradePrice is currently in a downtrend on the 1Hour timeframe. Price retested the orderblock on the 15min Timeframe with was also between the 0.62 and 0.78 fibonacci level. Price is now rejecting the oredrblock and looking to continue to the down trend. We are targetting a 1:2 RR and Stoploss and takepro

See all forex ideas

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.