BTCUSD might give Structure Shift Now✅ Pattern: Potential Inverse Head & Shoulders

Look closely:

Left dip → around 76.8k

Deep dip (Head) → around 75k

Right dip → higher low near 76.5k

Now price is pushing back up

This is a classic reversal structure.

✅ Important Level: Neckline Resistance

The dotted zone you marked around:

79,

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

Texas Instruments breaks into price discovery above ATH1 Trend is constructive and the breakout came after a long base, not a random spike

2 The old high was reached, tested, then broken, now price is in discovery

3 The key is whether the market can hold above the breakout zone and stay accepted there

4 Pattern labels are visual context only, they are n

TRADINGVIEW IS LOOKING FOR A NEW INDIAN REGION MODERATOR!Join Our Team: Exciting Opportunity to Become a Moderator for the Indian Region Community at TradingView!

Hello TradingView Enthusiasts,

Are you passionate about trading and the TradingView platform? We are on the lookout for a new moderator to join our INDIAN REGION Community and help elevate th

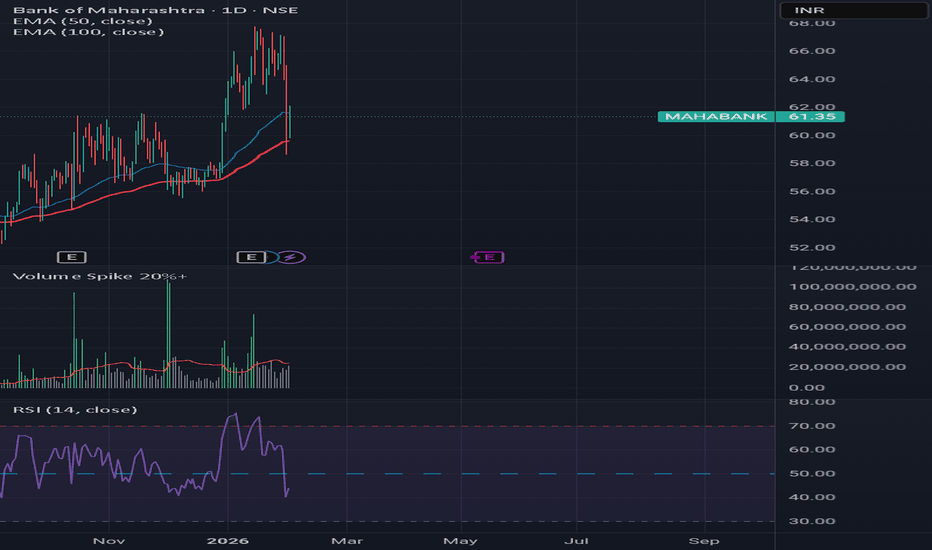

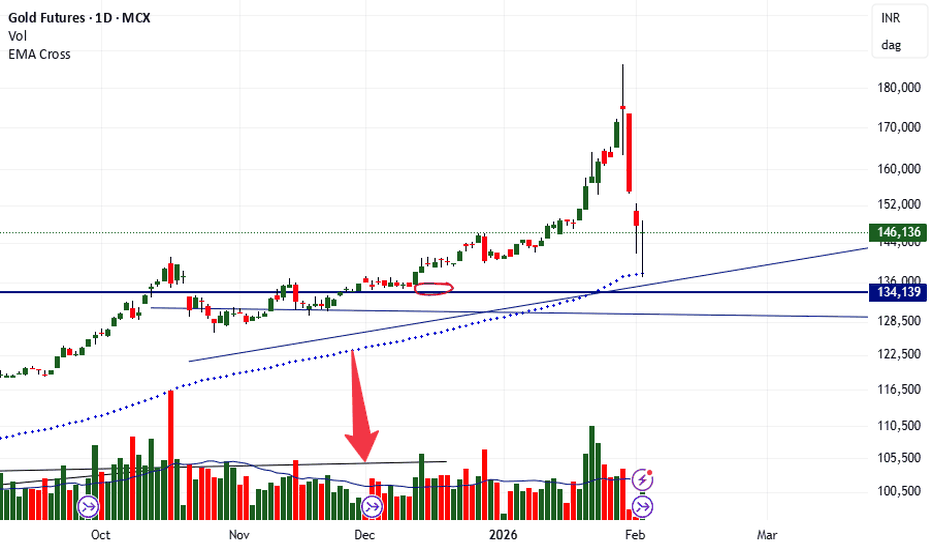

Market Outlook & Trade Setup – Monday, 2nd Feb 2026Major indices corrected heavily yesterday during the Budget announcement due to the increase in STT in F&O and no respite in LTCG.

Nifty, Sensex and Bank nifty went minus by almost 500,1200 and 1500 points respectively. We expect the selling to continue further. Additionally, the selling in metals c

PTL Trade SetupCurrent Market Price (CMP): 41.50

Breakout Context: Consolidation breakout confirmed yesterday with strong volume, which adds conviction.

Target: 46.62 (approx. +12.3% from CMP)

Stop Loss: 40.03 (risk of about -3.5% from CMP)

Key Notes

- A breakout with volume often signals genuine momentum, but

KAYNES above 3427 – Breakout or Pullback?KAYNES Technology India has strong long-term earnings growth and good profit and revenue growth over recent years, supported by expanding electronics & EMS market trends.

The stock trades with a relatively high P/E but is backed by a firm order book and industry relevance.

Despite recent volatility

Expecting audcad sell delivery for buy setupsBetween these two red lines inside weekly+daily imb, the set-up could be find for buys

Why? Price already taken the liquidity above and it possible scenario

shows the probability

of retracement ( where structure shift indicates sellside delivery,

however buys will be

more safer approach fundam

PAGEIND M PATTREN BREAKDOWN 31 01 2026📈 1) Pageind Pattern Structure: M-Pattern / Double Top

An M-Pattern (Double Top) is a bearish reversal pattern with the following components:

Left Top → Right Top ≈ equal highs

Neckline → horizontal support connecting the swing lows between tops

Breakdown → close below the neckline confirms the pat

BSE-Likely Cup &Handle Break outBSE:

Trading at 2881 and above all its critical Moving averages Viz10/20/50/10 DEMA

In daily chart has formed C&H Pattern,

Based on the pattern and price volume suggests -breaking the Neckline resistance at 2880-2900 likely to test 2950/3000+ shortly(For educational purpose only)

See all editors' picks ideas

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

See all indicators and strategies

Community trends

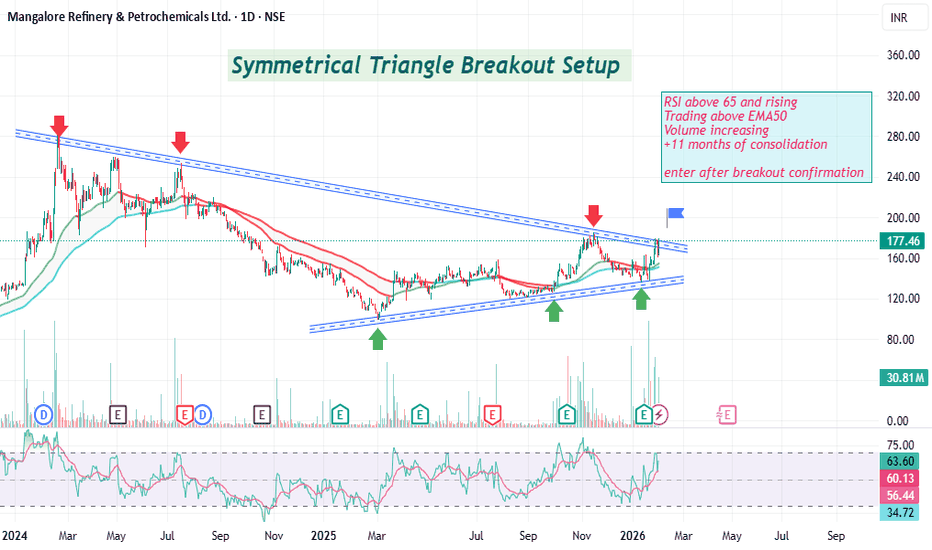

Symmetrical Triangle Masterpiece : Multi-Layout W,DtfStep into this dynamic multi-layout window opened right in front of you—a split-screen showcase of pure price action artistry.

Left Side: Weekly Timeframe

Here, a symmetrical triangle (a classic continuation or reversal pattern formed by two converging trendlines of equal slope) takes center stage.

PTL Trade SetupCurrent Market Price (CMP): 41.50

Breakout Context: Consolidation breakout confirmed yesterday with strong volume, which adds conviction.

Target: 46.62 (approx. +12.3% from CMP)

Stop Loss: 40.03 (risk of about -3.5% from CMP)

Key Notes

- A breakout with volume often signals genuine momentum, but

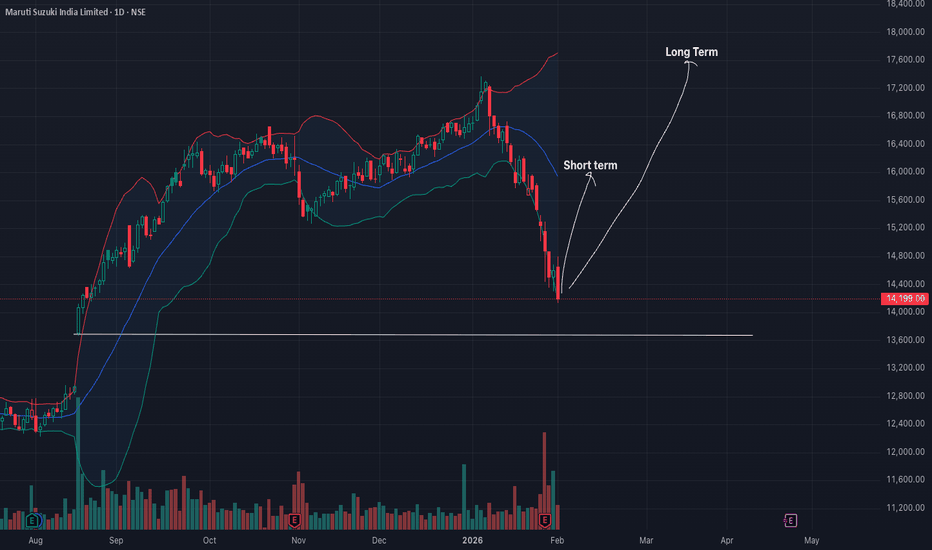

Maruti Suzuki: Gearing Up for a BreakoutMaruti Suzuki (MARUTI) is currently at a strategic inflection point, exhibiting a super bullish outlook as it transitions from a traditional ICE powerhouse to an EV contender. Fundamental strength is anchored by a record-breaking Q3 FY26, where net sales surged 29% YoY to ₹475 billion. The imminent

BLUESTARCO – Pure Price Action in ActionBLUESTARCO was moving inside a falling channel for a long time, where price kept coming down from the upper trendline and taking support at the lower trendline, showing how clearly it respected the structure. Recently, price reached the lower support again and bounced strongly, which tells us that s

GMRAIRPORT: The "Double Bottom" Reversal is ON!GMRAIRPORT ,after a sharp correction from the ₹110 peak, stock has found its "Iron Support" at ₹89, completing a classic Double Bottom formation. We are now entering the most critical zone of the chart.

📊 The Game Plan:

Decisive Zone: ₹94.00 – ₹95.45. Historically, this is where the big moves start

See all stocks ideas

Today

KTKBANKKarnataka Bank Ltd.

Actual

—

Estimate

7.70

INR

Today

BLSBLS International Services Ltd.

Actual

—

Estimate

3.94

INR

Today

SUPRIYASupriya Lifescience Limited

Actual

—

Estimate

—

Today

INDOCOIndoco Remedies Limited

Actual

—

Estimate

−2.55

INR

Today

NAZARANazara Technologies Ltd.

Actual

—

Estimate

0.36

INR

Today

VIPINDV.I.P.INDUSTRIES LTD.

Actual

—

Estimate

−2.46

INR

Today

INDHOTELIndian Hotels Co. Ltd.

Actual

—

Estimate

5.08

INR

Today

WELSPUNLIVWelspun Living Limited

Actual

—

Estimate

0.02

INR

See more events

Community trends

BTCUSD might give Structure Shift Now✅ Pattern: Potential Inverse Head & Shoulders

Look closely:

Left dip → around 76.8k

Deep dip (Head) → around 75k

Right dip → higher low near 76.5k

Now price is pushing back up

This is a classic reversal structure.

✅ Important Level: Neckline Resistance

The dotted zone you marked around:

79,

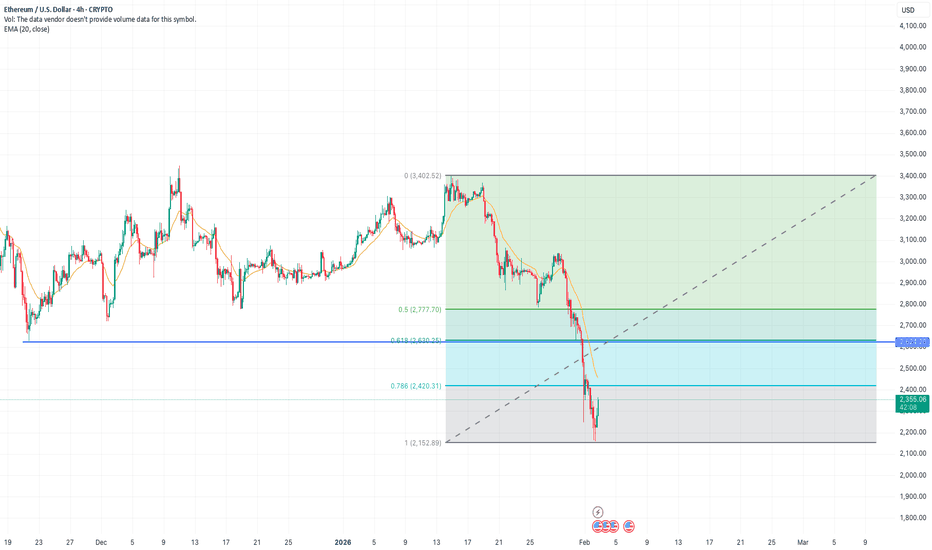

ETH Reversal or just a pullback?CRYPTO:ETHUSD

Looking at the 4hr TF of ETH. it looks taking a minor pullback from the downward trend.

Yet it has to close Above $2620 to break the character of the current downtrend.

Highly likely it will chase this number successfully as more people are coming in with sentiment of buying the

Why Bitcoin’s Stability Is a Warning, Not StrengthBitcoin’s inability to participate in the recent “debasement trade” is not a sign of hidden strength — it’s a sign of waning relevance in the current macro cycle.

While gold and silver surged during the final euphoric phase, Bitcoin’s stagnation near $82,000 suggests that capital actively chose har

$BNB has officially retraced ~47% from its ATH (1374 on Oct 13CRYPTOCAP:BNB has officially retraced ~47% from its ATH (1374 on Oct 13, 2025) and just tagged the 728 zone, which is now the lowest point of this entire correction.

This level is not random. It’s where long-term structure meets fear.

Right now, price is sitting on a major decision area — and thi

Bitcoin Bybit chart analysis FEBURARY 2Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is Bitcoin's 30-minute chart.

The Nasdaq indicators will be released shortly at 12:0

$DOGE at the EXACT Level That Triggered 17,000% Pump - Repeat?CRYPTOCAP:DOGE at the EXACT Level That Triggered 17,000% Pump - History About to Repeat? 🚀

They Laughed at $0.003

They Sold at $0.10

They’ll FOMO above $1.00+

This Weekly / 2W Chart is Screaming Accumulation:

✅ Macro Demand Zone Holding at $0.10–$0.06

✅ Price Respects a Multi-Year Strong Support

BTCUSD/BITCOIN SELL PROJECTION 03.02.26BTCUSD SELL PROJECTION | Market Breakdown Explained

“Let’s break down the current BTCUSD market structure and why the sell bias is still valid.

Bitcoin is clearly trading inside a parallel downtrend channel, showing strong bearish continuation. After a strong impulsive drop, price attempted a pull

See all crypto ideas

$TVC:SILVER MOON MISSION:2025-29 is History Repeating Again? TP?🚀 Silver Feature Analysis 2026 – 2029: The Historical Repeat 🚀

TVC:SILVER has recently hit its All-Time High (ATH) three times in history with massive rallies. My analysis is based on the duration and percentage returns of these specific periods:

1️⃣ 1980: (1 Aug 1979 to 29 Jan 1980) – A 6-month

XAUUSD: Liquidity Swap Near PDL – Relief Bounce Into Sell ZoneDescription

Gold is currently trading inside a key liquidity zone after a strong bearish impulse.

Price swept sell-side liquidity and is now showing a short-term corrective bounce.

What I’m seeing:

Clear bearish market structure (lower highs & lower lows)

Price reacting from sell-side liquidity

XAUUSD/GOLD PMI NEWS FORECAST 02.02.26XAUUSD / GOLD – ISM Manufacturing PMI Trade Plan

Date: 02-02-2026

Hello traders,

Welcome back to Tamil Trading Education.

Today we are analyzing XAUUSD (Gold) based on the ISM Manufacturing PMI news.

This is a news-based breakout and retest strategy, so please avoid emotional or early entries.

🔑

XAUUSD – High volatility, monitor key reaction zones.📌 Market Context

Gold is currently trading in a high-volatility environment after a sharp drop below the $5,000 level, reflecting aggressive repricing ahead of major macro uncertainty. The market has shifted away from smooth trend behavior into a liquidity-driven, fast-reaction phase, where price m

Crude Oil: The Market Is Revisiting the Scene of the BreakdownCrude Oil is revisiting a level where a major structural breakdown occurred in the past.

Markets don’t forget such zones easily. What once triggered aggressive selling often turns into active supply when revisited.

The recent move is not random strength — it’s a retest of prior imbalance, followed

XAUUSD - Brian | H1 AnalysisXAUUSD – Brian | H1 Technical Outlook – SELL Bias Aligned With the Main Trend

Gold is entering a strong corrective phase after forming a short-term top, with the H1 structure clearly shifting to the downside. The latest bearish leg is impulsive in nature, reflecting active position unwinding and sh

Gold intraday levelsPrevious Day High: 4885 – 4888

→ Acts as a major intraday resistance. A clean breakout and hold above this zone can open upside momentum.

Previous Day Open: 4831

→ Key intraday pivot level. Price reaction around this zone will decide bullish or bearish bias.

Previous Day Close / Demand Zone: 4655 –

See all futures ideas

EUR/USD – 1H EURUSD is trading at a discounted price area after a sharp impulsive sell-off, where price has swept sell-side liquidity (LA) and is now stabilizing near equal lows. The recent bearish leg looks exhaustive, suggesting downside momentum is weakening.

Price is currently holding above a key intraday d

EURUSD - WEEKLY OUTLOOKOn the Monthly & Weekly timeframes, EURUSD remains bearish.

Price is currently holding in the premium area and has printed a strong weekly rejection candle from a monthly Order Block, which supports downside continuation.

🔍 Daily Perspective

Expectation is for price to move into the discount area,

DAILY FOREX SCAN Session – 23 03 02 26Scanning multiple forex pairs to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial

Expecting EurCHF bearish Why should we trust this idea 💡??Eur has 2.15% interest rate ,while chf is safe heaven currency so

it would shows always significant strength towards chf ,apart from that any Ongoing panic

global events will also cause CHF bullish with aligning the price action parameters by following liquidity 💲⚔

EURUSD - 4H - SHORTFOREXCOM:EURUSD

Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. wait for more Smart Money to develop before taking any pos

See all forex ideas

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.