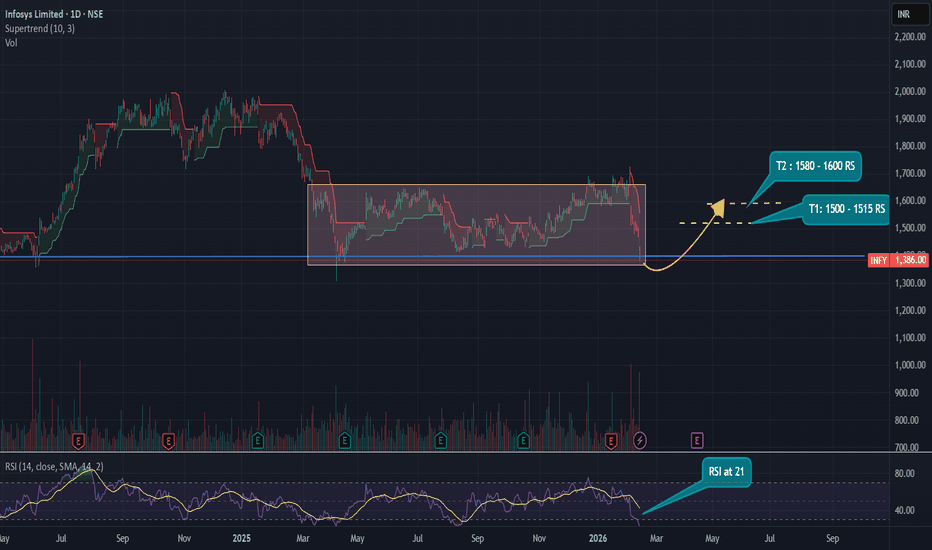

Infosys LimitedInfosys Technical Outlook :

Infosys has been consolidating within the ₹1400–₹1700 range over the past year. Currently, the stock is in the oversold zone, with the RSI at 21, and is testing a strong support level around ₹1400.

From a mid-term perspective, the setup looks attractive:

- Target 1: ₹1500

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

$ETH has officially lost the 2000–2020 base CRYPTOCAP:ETH has officially lost the 2000–2020 base we highlighted on the 1H chart.

Triple-top rejection (Top 1 → Top 2 → Top 3) played out perfectly — buyers failed at the 2140–2160 supply zone, and breakdown followed.

📍 First reaction target (1980–1950) ✅ Hit

That’s roughly a 2.6–3% move from

Hindustan Unilever : Prepared for Upside Hindustan Unilever – Failed Head & Shoulders Turning Bullish (Daily Chart)

On the daily timeframe, Hindustan Unilever was forming a well-structured Head & Shoulders pattern. The left shoulder, head, and right shoulder were clearly visible, with a defined neckline acting as support.

However, instea

SBILIFE: "Change of Character" Signaling somethingThe Technical Breakdown (Educational Guide)

The chart displays a beautiful confluence of Smart Money Concepts (SMC) and Fibonacci retracement. If you’ve been looking for a textbook "Buy the Dip" setup, this is it! Here are 4 key educational points from this chart:

1. The Choch (Change of Character)

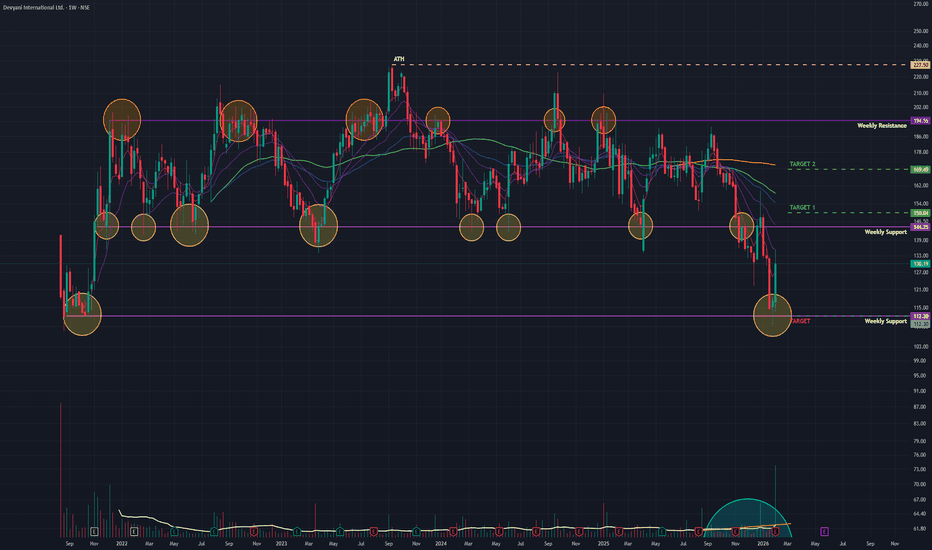

Devyani Int (W): Aggressive Bullish, Turnaround at Major Support(Timeframe: Weekly | Scale: Logarithmic)

The stock has confirmed a major "V-Shape Reversal" from its long-term support zone of ₹110. The surge is backed by "Climax Volume" and a positive reception to its Q3 operational updates, signaling that the 2-year correction might be over.

🚀 1. The Fund

Nykaa: Descending Trendline BreakoutNykaa respected the rising structure even during the correction and never lost its trend strength.

Price held the sloping support, absorbed selling pressure, and then gave a clean breakout above the key horizontal resistance around 277 with strong volume.

This move shows acceptance above resistanc

The crypto has found its supportBitcoin CMP $70690

The beauty of looking at various asset classes is that they rise and fall together. In my view the correction in the crypto is over.

Elliott- The v waves within the C wave is done. Hence to me this correction is over.

Fib- The crypto reversed just shy away from the 59K whic

NTPC.. Moved outside the channel..NTPC.. Trying its level best to move.

Selling pressure in market pulled it back and retested the support.

Now things can be interesting..

Moved above this channel then first target can be somewhere around 370, the exact level from where it faced resistance today..

Second can be somewhere around

Nifty Energy: Final Bounce Before the Deeper CorrectionThe Nifty Energy Index continues to trade within a higher-degree corrective structure rather than a fresh impulsive uptrend.

The decline from the highs appears to have completed Wave W, followed by an ongoing recovery in Wave X.

In the near term, the structure allows for one more upside phase . A

Dead Cat Bounce in Nifty? Heavyweights to Deliver The VerdictDead Cat Bounce in Nifty? Index Heavyweights to Deliver the Verdict Soon…

Both index heavyweights remain structurally weak despite the recent bounce.

On the daily timeframe, Reliance Industries and HDFC Bank have transitioned out of bullish Ichimoku regimes. Crucially, the second daily Kumo

See all editors' picks ideas

Peak Trading Activity Graphs [LuxAlgo]The Peak Trading Activity Graphs displays four graphs that allow traders to see at a glance the times of the highest and lowest volume and volatility for any month, day of the month, day of the week, or hour of the day. By default, it plots the median values of the selected data for each period. T

Smart Trader, Episode 03, by Ata Sabanci, Candles and TradelinesA volume-based multi-block analysis system designed for educational purposes. This indicator helps traders understand their current market situation through aggregated block analysis, volumetric calculations, trend detection, and an AI-style narrative engine.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Asset Drift ModelThis Asset Drift Model is a statistical tool designed to detect whether an asset exhibits a systematic directional tendency in its historical returns. Unlike traditional momentum indicators that react to price movements, this indicator performs a formal hypothesis test to determine if the observed d

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

See all indicators and strategies

Community trends

Infosys LimitedInfosys Technical Outlook :

Infosys has been consolidating within the ₹1400–₹1700 range over the past year. Currently, the stock is in the oversold zone, with the RSI at 21, and is testing a strong support level around ₹1400.

From a mid-term perspective, the setup looks attractive:

- Target 1: ₹1500

Positional View for Infyosys Ltd.Wrap up:-

As per chart of Infosys Ltd., it seems that correction in the stock is now over with a abc pattern in major wave 4. Now, major wave 5 is started of which inner wave 1 is completed at 1649 and wave 2 is expected to be completed in the range 1433-1307.

What I’m Watching for 🔍

Low Risk

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that

BAJFINANCE: At a Decisive Crossroads!The gap-up and volatility we're seeing today in BAJFINANCE are driven by two main factors:

India-US Trade Deal Euphoria: The broader market surged today after US President Donald Trump and PM Modi announced a historic trade deal. This sparked a massive rally across the Sensex and Nifty (up over 2.5

Hindustan Copper – Breakout, Retest & Bullish Continuation SetupNSE:HINDCOPPER

Hindustan Copper has delivered a powerful breakout followed by healthy consolidation near highs — indicating strength rather than exhaustion.

Technical Observations

Breakout zone: ₹570–₹590 area (now acting as support)

Current structure: Flag-type consolidation near highs

Volume:

TCS 1 Month Time Frame 📌 Approx Current Price (Feb 2026)

• TCS price recently traded around ₹2,700–₹2,950 on NSE.

📉 Important 1-Month Levels — Support (Buy Zones)

• S1 ~ ₹2,910–₹2,915 — first support & pivot area.

• S2 ~ ₹2,880–₹2,880 — secondary support (near recent lows).

• S3 ~ ₹2,840–₹2,850 — deeper support zone if

See all stocks ideas

Tomorrow

LUXINDLux Industries Ltd.

Actual

—

Estimate

—

Tomorrow

PTCILPTC Industries Ltd

Actual

—

Estimate

20.30

INR

Tomorrow

EFCILEFC (I) Ltd.

Actual

—

Estimate

—

Tomorrow

SIGACHISigachi Industries Limited

Actual

—

Estimate

—

Tomorrow

CELLOCello World Limited

Actual

—

Estimate

3.70

INR

Tomorrow

NBCCNBCC (INDIA) LIMITED

Actual

—

Estimate

—

Tomorrow

UNIECOMUnicommerce eSolutions Limited

Actual

—

Estimate

—

Tomorrow

EMMBIEmmbi Industries Limited

Actual

—

Estimate

—

See more events

Community trends

BTC short term Semi Triangle Bearish Structure BTC keeps creating a bearish semi-triangle after recovery from 59.7k, suggesting bearish momentum is still in place. In order to create a bullish divergence btc needs to go down one more round, let's say around 57k, and print bullish RSI onthe daily, that will Create a chance for rellief Rally. Whic

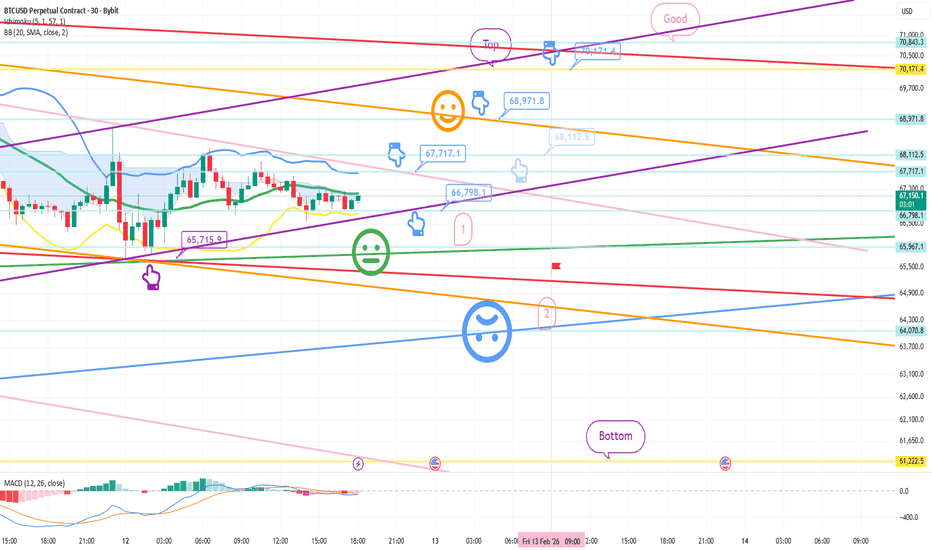

Bybit chart analysis FEBURARY 12 Bitcoin

Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a 30-minute Bitcoin chart.

The Nasdaq indicators will be released shortly at 10:

$BTC on the 1Hr is now tightening inside a descending triangleCRYPTOCAP:BTC on the 1Hr is now tightening inside a descending triangle, with clear lower highs pressing against a flat-to-rising base around 66k–67k. This is classic compression after a heavy selloff — volatility contracts before expansion.

Right now, price is sitting at the apex zone, meaning th

BTC Reversal or still bearish (13/02/2026).BTC is trading in a parallel channel.

Major Trend :- Bearish

Minor Trend :- Range Bound.

A bearish scalp trade can be taken upto the support levels of the channel. With a SL being a candle closing above the channel.

If there are halt candle near the resistance levels and a BO occurs, a 1000 point

Chainlink Analysis (Monthly Chart)Chainlink have given a bearish breakout of the head & shoulder pattern, and is sustaining lower, but till now prices have not retested the neckline, thus the pattern is not yet complete.

Overall, prices are expected to rise to retest the neckline before confirming its trend.

Also, the prices recent

BTC Monthly Levels — February (As of 12 Feb)This is a market-structure map from my NeuralFlow algorithm — educational only. No trade calls, no signals, no recommendations.

Context:

BTC has already tagged the lower monthly target zone (the 67,221–68,690 pocket) and the tape is now stabilising rather than accelerating lower. That tells you one

See all crypto ideas

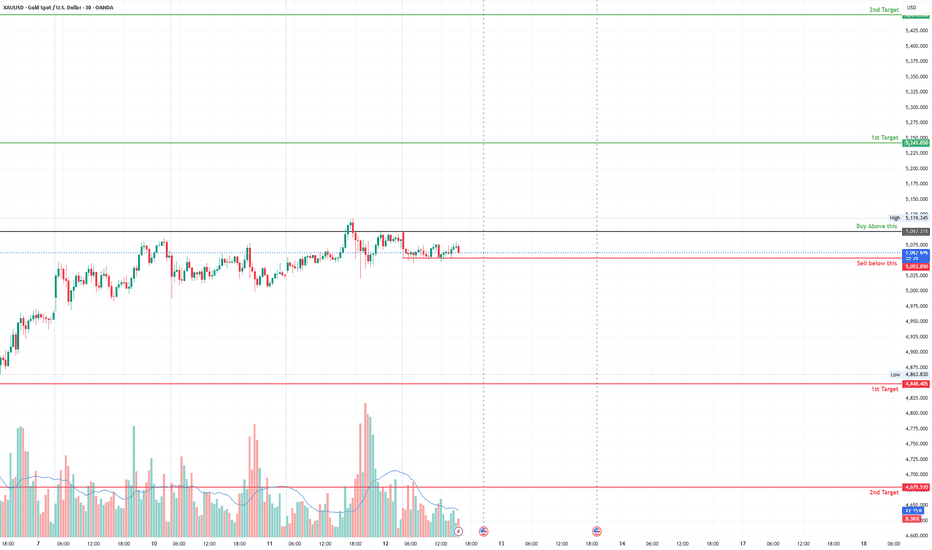

Gold (XAUUSD) – 1H Technical Analysis

Gold has broken a major ascending trendline, signaling a short-term shift from bullish structure to corrective/bearish.

🔎 Market Structure

Clear trendline breakdown after multiple higher lows. Strong bearish impulse from the 5080–5100 resistance zone. Price currently attempting a pullback after s

Gold Trading Strategy for 13th Feb 2026🟡 GOLD TRADING SETUP

📈 BUY SETUP (Bullish Breakout)

🔔 Condition:

Buy only if price breaks and closes above the High of the 1-Hour Candle and sustains above 5003

✅ Entry: Above 5003 after proper candle close

🎯 Targets:

• 🎯 T1 – 5015

• 🎯 T2 – 5028

• 🎯 T3 – 5045

🛡 Stop Loss: Below the breakout candl

XAUUSD (H1) – Structural Breakdown ActiveXAUUSD (H1) – Structural Breakdown Still Active | Medium-Term Sell Continuation Into Weekend

Gold is attempting to stabilize after a sharp downside expansion, but the H1 structure still points to sell-side control. The latest bounce is corrective and is currently rotating back into former support t

XAUUSD (Gold) | BEST TRADING SETUP | 13th Feb'2026Gold is trading near 4957 with short-term bearish pressure, while the higher timeframe trend remains bullish.

Lower timeframes show selling momentum, indicating a possible correction. However, the overall structure on Daily & Weekly charts still supports buying on dips.

Key Levels

Resistance: 4975

A-Book vs B-Book: What Every Retail Trader Needs to KnowMost retail CFD traders have never even heard the terms “A-Book” and “B-Book,” yet almost all of them are directly affected by how these models work. Your broker’s choice between the two can change the prices you see, how your orders are filled, and even whether your stop loss gets hit. Let’s break

XAUUSD – Trendline Break and RetestXAUUSD – Trendline Break & Retest: Bearish Signals Emerging | Lana ✨

Gold is showing early signs of structural weakness after breaking below the ascending trendline. The recent rebound appears corrective rather than impulsive, with price now retesting a key sell-side FVG zone near the former trendl

gold spot or silver update at the time of cpi datagold spot overview-- usa cpi data today at 7 pm at that time eyes on level----- gold spot hurdle 4986--91$ if market sustain above after cpi data than expect to up side 5035--5060--5080$ again hurdle 5110$ till no sustain above or close market revert--------- where support 4900-4890$ if market sust

Gold Analysis & Trading Strategy | February 12–13🎉🎉🎉Congratulations to the members who strictly followed our trading plan today.

✅ Today’s market movement largely aligned with our previous analysis — after facing strong resistance around the key 5075 level, gold’s momentum clearly weakened, followed by a significant pullback.

✅ When price reache

Gold (XAUUSD) H1 Analysis Today – Major Support, Resistance & NeMarket Structure Overview Higher Context

Strong impulsive sell-off from the 5,550–5,600 region.Clear Lower High → Lower Low sequence formed.Recent bounce is corrective, not impulsive.

Current Structure (H1)

Price recovering from 4,450 swing low.

Now consolidating near 5,050–5,100 zone.

Momentum sl

See all futures ideas

AUDJPY – Bullish Reversal From Trendline SupportAUDJPY is reacting strongly from a major ascending trendline support on the 1H timeframe. Price swept liquidity below the structure, tapped into the demand zone, and immediately rejected — signaling buyer strength.

we entered long around 108.180, which aligns perfectly with the technicals.

📈 Why T

EURUSD - 4H - SHORTFOREXCOM:EURUSD

Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. wait for more Smart Money to develop before taking any pos

See all forex ideas

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.