NBCC (India) Ltd | Weekly Consolidation Breakout SetupNBCC is showing a constructive weekly structure after a healthy pullback.

Price is holding above key moving averages

Higher lows indicate trend continuation

Tight consolidation near resistance suggests accumulation

Setup favors a range breakout on strength

Trade View:

Buy on strength above ₹125

Su

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetThe unlikely astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

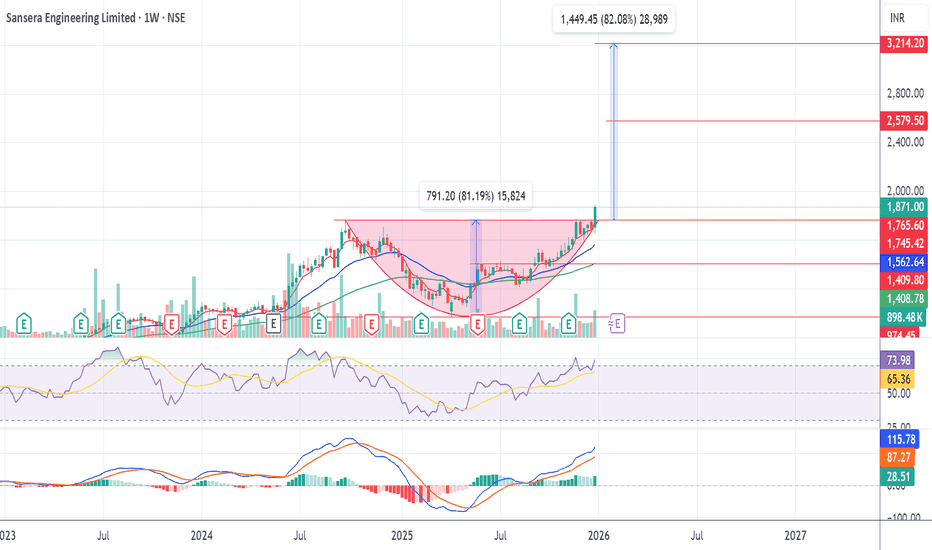

SANSERA ENGG@1871Not a SEBI registered, just sharing idea. On weekly time frame SANSERA @1871 gave breakout from rounding bottom @1767 with volume. Entry can be made 1871 and @1767, SL-1700 Target 1-2600 in 2-3 month, 2-3300 in 5-6 month. It is in Bull trend RSI on DAILY, WEEKLY >70 and MONTHLY>=70.

Crompton Greaves Falling?Technical (upgrade)

Crompton Greaves Consumer Electricals has been sliding inside a falling wedge, but price is trying to base around ₹248-252 (teal support on your chart). A daily close above ~₹260–262 (wedge top/near-term trendline) would confirm a breakout and set up a move toward ₹275 first an

BHEL – Weekly Trendline Still in ControlBHEL continues to trade in a strong uptrend on the weekly timeframe, with price respecting the rising trendline and closing near the recent highs around ₹299.50. The series of higher highs and higher lows remains intact, and the latest bullish weekly candle reinforces the strength of buyers along th

Crompton Greaves Cmp 252 Reversed from supportCrompton Greaves Cmp 252 dated 2-1-2025

1. Rectangle Consolidation

2. Price reversal from support

3. Price increase with Volumes

4. RSI reversal

5. Good Risk Reward Ratio

Buy above 254 SL 245 target 256-258-260-262-265

268-270-272-275-280

It is just a view, please trade at your own risk.

BPCL : Trading the Confluence of Price Action & Macro TailwindsThe stock has been consolidating within a defined range over the past few weeks and has recently started forming a solid base. While the breakout volume isn’t a classic “God-candle,” price action continues to hold firmly above key moving averages, which is a constructive sign. That said, the price i

GIFTNIFTY IntraSwing Levels For 02nd JAN 2026🚀Follow & Calculate Premium with NIFTY Post for NF Trading

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibility / Probability of REVERSAL near RLB#1 & UBTgt

L#3: If the candle stays above “Sell

CONCOR – 1D | 10-Year Support & Trendline BreakoutCompany Intro:

Container Corporation of India Ltd (CONCOR) is a Navratna PSU and India’s largest integrated logistics company, operating inland container depots (ICDs), container freight stations (CFS), and rail-based logistics services. It plays a key role in India’s EXIM trade and domestic freight

See all editors' picks ideas

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

Trend Line Methods (TLM)Trend Line Methods (TLM)

Overview

Trend Line Methods (TLM) is a visual study designed to help traders explore trend structure using two complementary, auto-drawn trend channels. The script focuses on how price interacts with rising or falling boundaries over time. It does not generate trade sign

Breakouts & Pullbacks [Trendoscope®]🎲 Breakouts & Pullbacks - All-Time High Breakout Analyzer

Probability-Based Post-Breakout Behavior Statistics | Real-Time Pullback & Runup Tracker

A professional-grade Pine Script v6 indicator designed specifically for analyzing the historical and real-time behavior of price after strong All-Ti

See all indicators and strategies

Community trends

NBCC (India) Ltd | Weekly Consolidation Breakout SetupNBCC is showing a constructive weekly structure after a healthy pullback.

Price is holding above key moving averages

Higher lows indicate trend continuation

Tight consolidation near resistance suggests accumulation

Setup favors a range breakout on strength

Trade View:

Buy on strength above ₹125

Su

An Optimal Way to Enter a Trade- Breakout or PullbackThis chart highlights what could to be ideal trade opportunities when viewed in hindsight.

At first glance, many traders would assume the best entry was at the breakout, with a stop-loss placed below the breakout candle. However, that assumption ignores an important reality: at the moment of the br

SANSERA ENGG@1871Not a SEBI registered, just sharing idea. On weekly time frame SANSERA @1871 gave breakout from rounding bottom @1767 with volume. Entry can be made 1871 and @1767, SL-1700 Target 1-2600 in 2-3 month, 2-3300 in 5-6 month. It is in Bull trend RSI on DAILY, WEEKLY >70 and MONTHLY>=70.

MMFL: Stage 1 to Stage 2 Breakout SetupThe Core Thesis: Change of Character (Weinstein Stage 1 Breakout)

After a prolonged period of underperformance and sideways consolidation (the "Stage 1 Base"), MMFL has shown a clear Change of Character. The stock is emerging from its long-term accumulation zone, supported by a significant "volume

INDUSINDBK 1 Day Time Frame 📍 Latest Price Context

The stock recently closed around ≈ ₹902.45 on the NSE (close of 2 Jan 2026) with intraday range ~₹890‑₹910.

📊 Daily Technical Levels (Support & Resistance)

🔸 Pivot & Major Levels

Level Price (INR)

Pivot Point (Daily) ~₹900.8

Resistance 1 (R1) ~₹911.4

Resistance 2 (R2) ~₹92

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that

WELSPUNLIV | Weekly chart study | OpportunityWelspun Living in very well pinned as a short-term technical highlights, backed by a strong breakout structure on higher timeframes.

🔹 Key Points

📈 Buy Zone: ₹142 – ₹145

🎯 Targets: ₹162 – ₹170

🚨 Stop-Loss: ₹134

⏳ Expected Duration: 3–4 weeks

📈 Why This Setup Looks Bullish

✔️ Trendline Breakout:

Th

RELIANCE: US attack on Venezuela & Level Analysis❇️ New Delhi: The US attack on Venezuela is unlikely to have any material impact on Indian refiners, which had already exited Venezuelan crude due to sanctions. Venezuela is now a marginal exporter, and any supply disruption is unlikely to lift

💥India's Exposure: Venezuela supplies ~3-5% of Indi

Hidden Parallel Channel: Weighted Lines & Zones ExposedThis chart illustrates key technical elements where price interacts with multiple reference lines and zones, emphasizing their observed relevance based on proximity and historical behavior.

The red counter trend line, distant from price by 35-40%, carries less immediate weight, while the white cou

See all stocks ideas

Today

METROPOLISMetropolis Healthcare Ltd.

Actual

—

Estimate

8.78

INR

Jan 8

GTPLGTPL Hathway Ltd

Actual

—

Estimate

—

Jan 8

ELECONElecon Engineering Co. Ltd.

Actual

—

Estimate

—

Jan 8

EIMCOELECOEimco Elecon (India) Ltd.

Actual

—

Estimate

—

Jan 9

JUSTDIALJust Dial Ltd.

Actual

—

Estimate

13.95

INR

Jan 9

GLOBUSSPRGlobus Spirits Limited

Actual

—

Estimate

—

Jan 9

TEJASNETTejas Networks Ltd.

Actual

—

Estimate

—

Jan 10

DMARTAvenue Supermarts Ltd.

Actual

—

Estimate

11.29

INR

See more events

Community trends

BTCUSD 1H Market Structure and Important Price LevelsBTCUSD on the 1H timeframe is showing a stable price structure after a completed correction. The recent pullback found support near the 86,500 area, where selling pressure reduced and price stabilised. From this level, the market recovered and moved back above 90,000, indicating renewed bullish cont

Bitcoin buy recommended on Friday 94000 target hit 98000 next Parameter Data

Asset Name/LTP Bitcoin (BTC/USDT) LTP: $94,046.91

Time Frame of Analysis Short-Term/Swing (Daily & 4H Chart)

💰 Current Trade BUY ON DIPS Active. T1: $95,500, T2: $98,000, SL: $91,200.

📈 Price Movement 🟩 +2.74% (+$2,505). Day High: $94,232. Low: $91,541.

🌊 SMC Structure 🟩 Bullish: Tr

Weekly Analysis with buy/Sell scenarios in BTCAnother week and price is moved as expected in same range. No view change since last prediction.

Refer previous details below…

We analyzed three weeks back that BTC would be in range for some time before taking any further move, And BTC is following same analysis and trapped within a small range s

Bitcoin Bybit chart analysis JENUARY 5Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

There will be a Nasdaq indicator release at 12:00 PM s

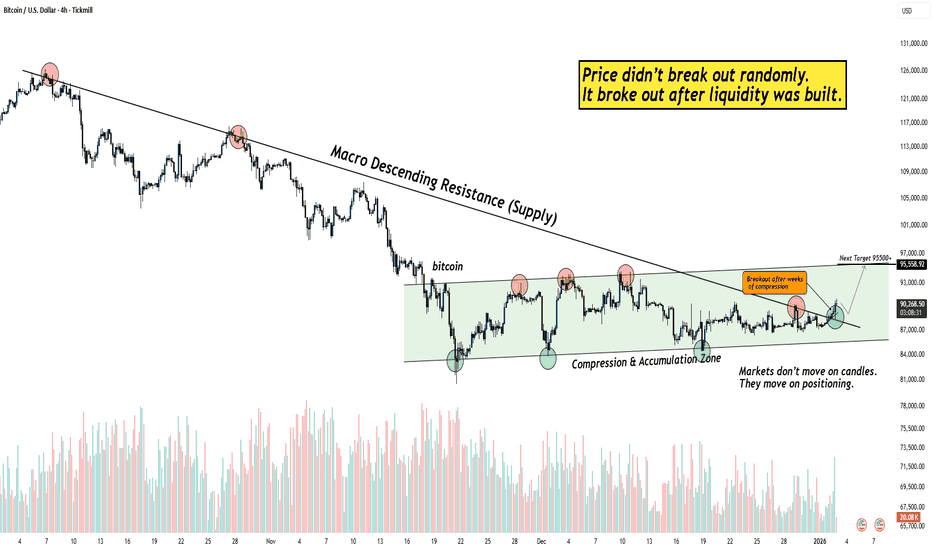

Why Bitcoin Broke Out After Weeks of Boring Price Action?Hello guy's let's analyse Bitcoin because for weeks, Bitcoin stayed inside a tight compression range while most traders lost interest. Price looked slow, directionless, and boring, exactly the phase where liquidity gets built quietly.

This breakout matters because it didn’t come after a spike.

It c

BTCUSDT – Elliott Wave Completion → Short Sell SetupPrice action on BTCUSDT appears to be completing a 5-wave Elliott impulse structure inside a rising wedge / channel. Waves (1)–(5) are clearly respected, with Wave (5) now testing a major trendline resistance zone around 91,800–92,000.

Momentum indicators are showing loss of strength near the top,

#BITCOIN is compressing inside a falling wedge on the lower time#BITCOIN is compressing inside a falling wedge on the lower timeframe after a strong impulsive move. This structure usually signals pause before expansion, not weakness. Price is respecting both trendlines cleanly, showing balance between buyers and sellers.

What matters now is how price exits this

ETHUSD | Premium Zone Reaction After Impulsive Rally (SMC Short Market Context

Ethereum has delivered a strong impulsive move to the upside, breaking previous structure and expanding aggressively from the discount region. Price is now trading inside a higher-timeframe premium zone, where distribution is likely to occur.

This area aligns with smart money profit

#BTC.P Up for next super cycle?

BTC is in a corrective downtrend within a defined channel and is currently reacting from a higher-timeframe demand zone. The setup anticipates a potential trend reversal contingent on a confirmed breakout and acceptance above the descending trendline and mid-range resistance. Upside expansion is

See all crypto ideas

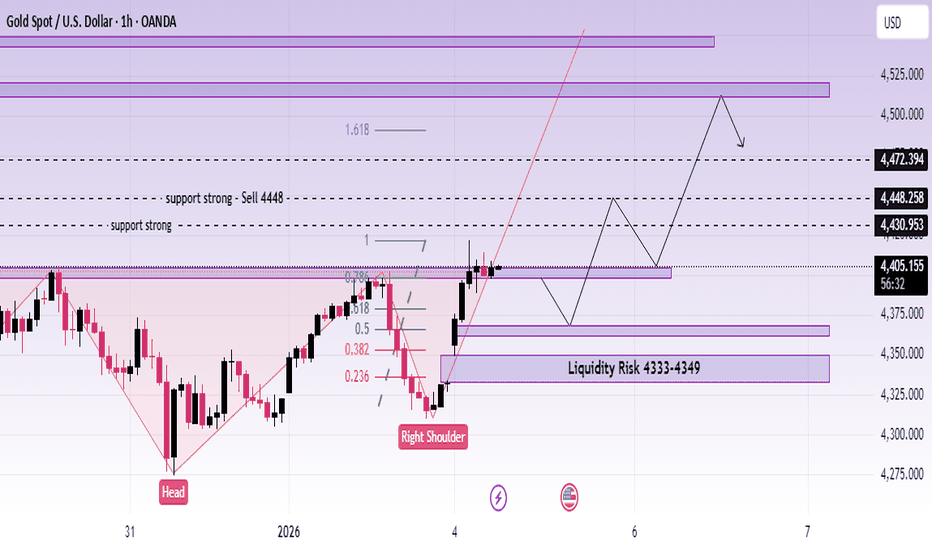

XAUUSD Smart Money Levels: Demand 4312, Supply 4436XAUUSD – Intraday Smart Money Plan | by Ryan_TitanTrader (05/01)

Market Context

Gold remains structurally bullish on higher timeframes, yet short-term price action shows pullback pressure after premium liquidity was elected near 4440. As markets brace for ongoing USD direction from macro catalyst

Gold Trading Strategy for 06th January 2026🟡 GOLD (XAU) INTRADAY TRADING SETUP 🟡

📈 BUY SETUP (BULLISH SCENARIO)

🟢 Buy Trigger:

➡️ Buy above the HIGH of the 1-Hour candle

➡️ Candle must CLOSE above 4456

🟢 Entry Confirmation:

✔️ Strong 1H candle close above resistance

✔️ Buyers showing strength above 4456

🎯 Buy Targets:

🥇 Target 1: 4468

🥈

XAUUSD (H1) – Inverse Head & Shoulders formingLana focuses on pullback buys above key liquidity 💛

Quick overview

Timeframe: H1

Pattern: Inverse Head & Shoulders confirmed on the chart

Bias: Bullish continuation while price holds above neckline

Strategy: Buy pullbacks into liquidity zones, avoid chasing highs

Technical view – Inverse Head

NATGAS CAPITAL (USD) Current Price: ~3.280 USD Bias: BullishNATGAS CAPITAL is holding in a strong demand zone (3.00–3.20). With weather still in play and colder patterns likely later this winter, heating demand may pick up — supporting natural gas prices and potentially pushing this instrument higher.

Immediate resistances at 3.51, 3.68, 3.92; breakout beyo

XAUUSD – M30 Trading Plan | Buy Demand + GAP–FiboAUUSD – M30 Trading Plan | Buy Demand + GAP–Fibo

🔍 Market Context (SMC)

The price has formed an upward BOS, confirming the short-term trend still belongs to the BUY side. The current decline is just a technical pullback to rebalance the cash flow, there is no bearish CHoCH → no reason to reverse th

Silver comex buy recommended near 72$ ,79$ to 80$ will come soonParameter Data

Asset Name/LTP Silver Comex (SI, Mar 2026 FUT) LTP: $76.620

Time Frame of Analysis Short-Term/Swing (Daily & 4H Chart)

💰 Current Trade BUY ON DIPS Active. T1: $78.00, T2: $80.00, SL: $72.50.

📈 Price Movement 🟩 +7.89% (+$5.605). Day High: $77.76. Low: $72.51.

🌊 SMC Structure 🟩 Bullis

XAUUSD Bullish Continuation | Buy the Dip @ 4400 - 4375Gold (XAUUSD) has delivered a strong bullish impulse following heightened geopolitical tensions involving the US and Venezuela. Price is holding firmly above the 4400 key support zone, signaling sustained bullish strength.

As long as gold maintains acceptance above this level, the bias remains bull

XAUUSD 1H Price Correction After Strong Rejection at 4550On the 1H chart, XAUUSD is showing a price correction after a sharp sell-off from the 4550 supply area. The rejection from this level clearly highlighted selling pressure from higher timeframes and caused a shift in short-term price structure, with gold unable to hold above higher price levels.

F

See all futures ideas

WHEN THE RUPEE SCREAMS, MARKETS WHISPERA 20‑Year Inter‑Market Study Linking USD/INR Extremes to NIFTY Turning Points

Executive Snapshot

For over two decades, the USD/INR exchange rate has followed a clearly defined long‑term rising channel. This study explores a powerful yet under‑discussed inter‑market relationship: Indian equity marke

GBPUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARDGBPUSD SHOWING A GOOD DOWN MOVE WITH 1:10 RISK REWARD

DUE TO THESE REASON

A. its following a rectangle pattern that stocked the marketwhich preventing the market to move any one direction now it trying to break the strong resistant lable

B. after the break of this rectangle it will boost the mark

EURUSD | HTF Demand Reaction After Liquidity SweepTrade Idea Overview

EURUSD is currently trading in a clear bearish structure, making lower highs and lower lows. Price has recently swept sell-side liquidity, tapped into a higher timeframe demand zone in discount, and reacted strongly from equilibrium — indicating potential mean reversion to the u

USDINR — Controlled Structural TrendUSDINR continues to trade within a long-term rising channel on the yearly timeframe.

The move reflects gradual structural INR depreciation , driven by macro differentials rather than stress or disorderly conditions.

No currency regime shift is visible at cycle degree.

Invalidation: Only a sust

See all forex ideas

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.