BSE-Likely Cup &Handle Break outBSE:

Trading at 2881 and above all its critical Moving averages Viz10/20/50/10 DEMA

In daily chart has formed C&H Pattern,

Based on the pattern and price volume suggests -breaking the Neckline resistance at 2880-2900 likely to test 2950/3000+ shortly(For educational purpose only)

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

JINDALSTELJINDALSTEL

bullish trend is Showing on the chart.

buy signals in

technical indicators and

cup with handle & ascending triangle chart pattern.

BUYING RANGE 1090/1100

Watch for a breakout above 1090/1100 to sustain the bullish trend. If the resistance holds, there could be a retest towards 975/980

FUSION - Time to shine?DISCLAIMER: This is NOT a trade recommendation but only my observation. Please do your own analysis before entering your trades

Points to note:

-----------------

1. Price has been in consolidation for 8 months inside a triangle

2. Attempt to breakdown was rejected with price swiftly moving back i

JSW Steel | Bull Continuation After Range Breakout target 1450🏭 Business Snapshot

JSW Steel is one of India’s largest integrated steel producers

Key beneficiary of infrastructure, construction, and capex-led growth

Strong domestic presence with improving capacity utilisation

Steel cycle + government infra spending provide sector tailwinds

(Business context

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that

COAL INDIA (1W) – Breakout From Long Consolidation | Key Levels 🟢 What’s Happening on the Chart?

• COAL INDIA was in a strong uptrend earlier and then entered a long sideways consolidation

• Price formed a solid base with multiple rejections from the same zone

• Recently, price broke and reclaimed the key resistance area

• Old resistance is now acting as new

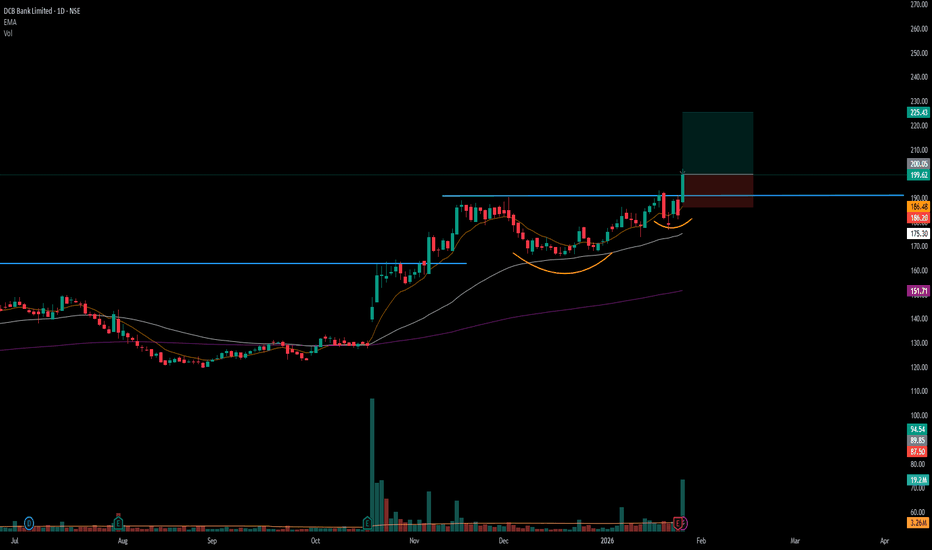

#DCBBANK - BreakOut in DTF with Volume Script: DCBBANK

Key highlights: 💡⚡

📈 C&H BreakOut in Daily Time Frame

📈 Volume spike during Breakout

📈 Base BreakOut

📈 RS Line making 52WH

📈 MACD Crossover

BUY ONLY ABOVE 200 DCB

⏱️ C.M.P 📑💰- 199.62

🟢 Target 🎯🏆 – 12%

⚠️ Stoploss ☠️🚫 – 6%

⚠️ Important: Market conditions are BAD, Avoid entering

IBEX ltd analysisJAN-2025

1. has got good move and then time correction.

2. Volume is contracting.

3. good momentum score, Good durabilty score.

2. quaterly profit & revenue has increased.

3. EPS has increased.

4. Debt has gone down.has low debt

5. No change in institution holding.

i am managing my risk by stop los

See all editors' picks ideas

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

See all indicators and strategies

Community trends

BUY TODAY SELL TOMORROW for 5%DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed that

FUSION - Time to shine?DISCLAIMER: This is NOT a trade recommendation but only my observation. Please do your own analysis before entering your trades

Points to note:

-----------------

1. Price has been in consolidation for 8 months inside a triangle

2. Attempt to breakdown was rejected with price swiftly moving back i

JINDALSTELJINDALSTEL

bullish trend is Showing on the chart.

buy signals in

technical indicators and

cup with handle & ascending triangle chart pattern.

BUYING RANGE 1090/1100

Watch for a breakout above 1090/1100 to sustain the bullish trend. If the resistance holds, there could be a retest towards 975/980

BSE-Likely Cup &Handle Break outBSE:

Trading at 2881 and above all its critical Moving averages Viz10/20/50/10 DEMA

In daily chart has formed C&H Pattern,

Based on the pattern and price volume suggests -breaking the Neckline resistance at 2880-2900 likely to test 2950/3000+ shortly(For educational purpose only)

JSW Steel | Bull Continuation After Range Breakout target 1450🏭 Business Snapshot

JSW Steel is one of India’s largest integrated steel producers

Key beneficiary of infrastructure, construction, and capex-led growth

Strong domestic presence with improving capacity utilisation

Steel cycle + government infra spending provide sector tailwinds

(Business context

ZEE Entertainment - Target 120With the recent result , we see a clear Head & Shoulder Pattern in hourly chart. One can keep a target of 120.

The Zee5 business has posted a EBITDA positive result which can be seen as turnaround. If promoters increase their holdings this can again reach to 140 levels.

COAL INDIA (1W) – Breakout From Long Consolidation | Key Levels 🟢 What’s Happening on the Chart?

• COAL INDIA was in a strong uptrend earlier and then entered a long sideways consolidation

• Price formed a solid base with multiple rejections from the same zone

• Recently, price broke and reclaimed the key resistance area

• Old resistance is now acting as new

DIXON 1 Week Time Frame 📊 Current Price Context

Current share price is roughly around ₹10,150–₹10,300 on NSE/BSE.

📅 1‑Week Time‑Frame Key Levels

📌 Major Weekly Support Levels

These act as zones where buyers may step in if price dips:

Support 1 (S1): ~₹10,040–₹10,050 – first defensive zone this week.

Support 2 (S2): ~₹9

See all stocks ideas

Today

STYRENIXStyrenix Performance Materials Ltd

Actual

—

Estimate

—

Today

AMBUJACEMAmbuja Cements Limited

Actual

3.49

INR

Estimate

4.41

INR

Today

JLHLJupiter Life Line Hospitals Ltd.

Actual

—

Estimate

22.50

INR

Today

SAILSteel Authority of India Limited

Actual

—

Estimate

0.91

INR

Today

HGINFRAH.G. Infra Engineering Ltd.

Actual

—

Estimate

18.42

INR

Today

MOILMoil Limited

Actual

—

Estimate

4.30

INR

Today

NHNarayana Hrudayalaya Ltd.

Actual

—

Estimate

11.80

INR

Today

MAYURUNIQMayur Uniquoters Limited

Actual

—

Estimate

—

See more events

Community trends

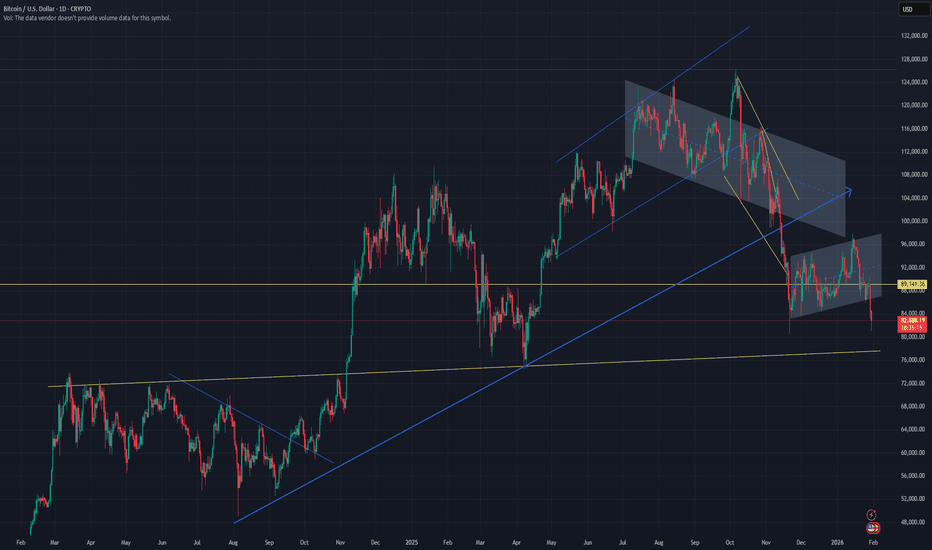

UPDATE: $BTC Breakdown Playing OutUPDATE: CRYPTOCAP:BTC Breakdown Playing Out

Bitcoin dumped below $85k, now trading near $84.4k.

We called shorts at $95k–$98k, and price rejected from ~$98k, delivering nearly 12% downside already.

The bear flag breakdown remains active, downside continuation favored.

Targets: $75k → $70k

Invali

BTCUSDT LONG Trade Of The YEARLonging BTC here for a swing isn’t a bad idea.

TP: ~100k

SL: 78k

BTC is underperforming GOLD and Retail is FOMO’ing into gold & traditional assets.

Narrative shifting to crypto is dead this cycle

Fear & Greed shows crypto traders are scared.

that’s exactly the signal.

that’s when smart money ste

BTC 4H UpdateAre we breaking out or faking out? 📉📈

Bitcoin is at a massive crossroads today, and the $91k level is the only thing that matters right now. We’ve seen some intense "chop" as the market prepares for today's FOMC decision.

My Technical Take:

Bullish Scenario: We need a clean flip of $91,195. If we

Bitcoin Is Reacting, Not Breaking, Patience Before the Next MoveWhen I look at this chart, I don’t see panic or trend failure. I see price pulling back into a clearly defined demand area within a rising structure and responding from it. That matters. If sellers were truly in control, price wouldn’t pause here, it would slice through demand without hesitation. In

(FOMC) Bitcoin Bybit chart analysis JENUARY 28Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a 30-minute Bitcoin chart.

The FOMC will announce interest rates at 4:00 AM tomor

Two Very Different Futures for Bitcoin Two Very Different Futures for Bitcoin 🔥

Don’t skip this one - the monthly chart decides

Bitcoin is approaching a critical decision zone on the monthly timeframe — one that could shape market behaviour well beyond short-term volatility.

From a structural and macro lens, a few developments stand ou

Perfect F&P on Bitcoins daily charts (21/01/26)Bitcoin forming good chart pattern on the daily charts.

The charts is a perfect example of a Flag and Pole pattern. If the pattern completes there are chance of seeing bitcoin dipping.

Identifying the last support around 85K. Be watchful if price dips below it.

#ETH ON THE EDGE DELTAIN:ETHUSD.P

ETH is on the edge of the cliff. If it breaks below this level, we can see a significant downward move to $2200 easily and worst case of $1500 & $1400.

Long term investors can accumulate on the supports. Follow me for more.

This indicator is provided for educational and inf

See all crypto ideas

Getting Creative on SilverThe RSI on Silver is now above 80/90 on all time frames, putting it in bubble territory. With the sixth consecutive day of gains going on, I am looking at the parallel channel and potential wedge formation for the next few days. Let us see if these trendlines can offer any resistance here. A reversa

XAUUSD Gold Next Move In Upcoming 2 Weeks ExpectedGold is Now Moving to 5600 to 5615 Which is Retracement level of 1.618 For Golds Previous Swing Extension levels and can expect a retracement of till 5000 to 5100 Levels In Upcoming Weeks Lets See WhatS Going to Happen..........# XAUUSD .. Check My 4hr chart Frame

XAUUSD/GOLD CORRECTION BUY PROJECTION 29.01.26XAUUSD / Gold – Correction Buy Setup (29-01-2026)

Market View:

Gold is in a strong bullish trend. The current move is a normal correction, not a trend reversal.

Buy Zone:

Support S2 + Fair Value Gap (FVG)

0.618 Fibonacci Golden Ratio

Area around 5396 – 5400

Trade Plan:

Look for buy confirmati

XAUUSD (H1) – Liam PlanUptrend intact, but signs of short-term exhaustion | Trade reactions, not impulse

Quick summary

Gold remains in a strong H1 uptrend, continuing to print higher highs and higher lows within a well-defined bullish structure. However, after the recent sharp advance, price is starting to slow near the

CRUDE OIL Moving towards 6700+CRUDE OIL Moving towards 6700+ after 5 Years ... Are we near the breakout of CRUDEOIL?

Crude OIL MCX is seen rising towards 6700+ Level post correction for 5 Months.

We seen big Rally in 2020-2021 on Crude OIL post COVID - post that we have seen 4 Years of correction on it. Now are we ready for up

Gold at Make-or-Break Zone | Channel Support Under TestGold is currently trading inside a rising channel and has pulled back toward the lower side of the structure. This move looks more like a healthy correction rather than a breakdown, as long as price continues to hold the marked support area.

If buyers step in near channel support, upside continuati

XAUUSD – Brian | M45 Technical Analysis— Buyers Still in Control Above 5,200

Gold continues to trade firmly above the 5,000 milestone, with price action confirming strong bullish acceptance at higher levels. On the M45 timeframe, the market remains in an expansion phase, supported by aggressive buying volume and well-defended value area

See all futures ideas

EURUSD 2H CHART EUR/USD Long Setup

Entry Zone: After price touches the bullish order block (OB) and shows rejection/reversal signals.

Direction: Long

Invalidation Level: Below the order block low.

Target: Next higher structure high (or previous swing high / liquidity zone above).

Rationale: Price is expected t

USDJPY Pullback Explained: Trend Support in Focus!For me, USDJPY is still behaving like a healthy uptrend, not a market that is rolling over. Price has been respecting a clear rising channel structure, with buyers consistently defending higher lows.

The recent move lower looks more like a pullback into major trend support rather than a sign of wea

CADJPY 2HR T/F ANALYSIS --- WE NEAD A RETESTING FOR SELL SIDE

📊 Market Structure Explanation (cadjpy – 2hr)

the structure are clear look like a strong bearish formation:- in this selling trend we can se imbalance also and our strong supply of previous demand which are marked clearly into green color they demand copy and past on recent demand bottom to top

AUDJPY : Bulls Defending the Line 106.60 !AUDJPY has undergone a significant correction, sliding from the 109.00 peak down to the 106.20 region. However, the bears have hit a massive roadblock. We are currently seeing a strong reaction from a historical demand zone (105.80 – 106.00), marked by the clear rejections in the shaded circles on t

DAILY FOREX SCAN Session – 20 (28.01.26)Scanning multiple forex pairs to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial

GBPUSD-Retracement Set up.(Not Trend Reversal)

GBPUSD is currently moving bullish, mainly driven by **USD weakness** rather than strong GBP strength.

This move is considered a **retracement**, not a full bearish structure change.

🔹 **Bias:**

➡️ Overall move is corrective

➡️ Bearish continuation only after retracement zones are reached

### 🎯

See all forex ideas

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.