INDUS TOWER ANALYSISTHIS IS MY CHART OF THE WEEK PICK

FOR LEARNING PURPOSE

INDUS TOWER- The current price of INDUS TOWER is 466.60 rupees

I am going to buy this stock because of the reasons as follows-

1. It is making a new high by breaking the resistance of last 9 years ( we often call this Multi year brea

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

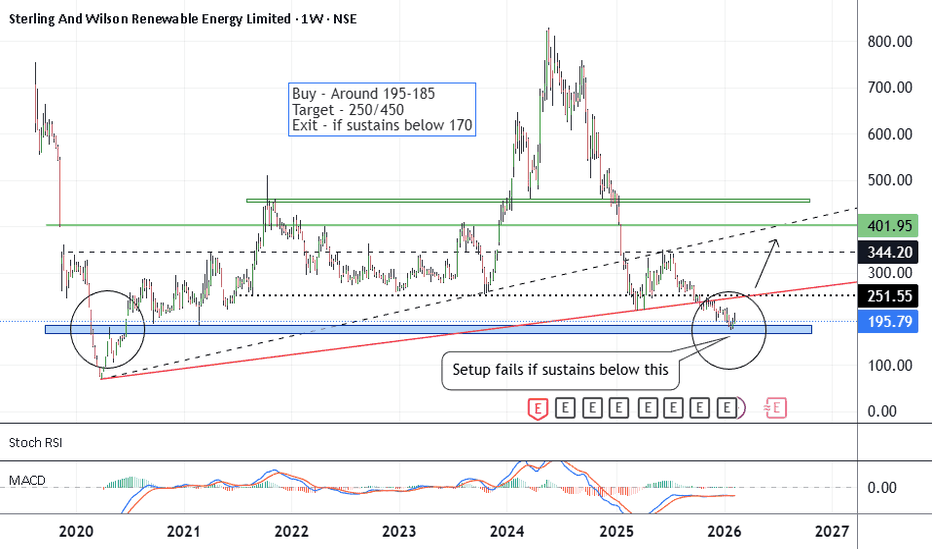

SW Solar - Bottom FishingCMP 195 on 14.02.26

As can be seen on the chart. There has been a big correction in the stock price in the past months. Presently trading near the lowest prices. If a reversal takes place, may go into a bullish phase ahead.

Possible targets may be 250/450.

The setup fails if it sustains below 170.

#Nifty Weekly 16-02-26 to 20-02-26#Nifty Weekly 16-02-26 to 20-02-26

25450-25650 is the sideways range for next week.

25800 will act as Resistance for next week.

Wait for above range to break on either side for a trending move.

Long level is above 25650 for the targets of 25780/25900.

Short level is below 25450 for the targets of 25

What to do in TCS if we are Holding?What to do in TCS if we are Holding?

Market Sentiment :

- Extremely week: Due to AI disruption Theory

Technical:

- Extremely Week: Daily, Weekly, Monthly Lower Lows formation

Should We Enter at this Level?

- No New Entry suggested unless we see Daily close above 20EMA

But I am already Hold

SILVER 1HRSWING TRADE

SILVER (XAGUSD) Looking good for Downside..

When it break level 73.77 and sustain.. it will go Downside...

SELL @ 73.77

Target

1st 63.89

2nd 56.48

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome..

Like this Post??? Hit like button..!!!

Foll

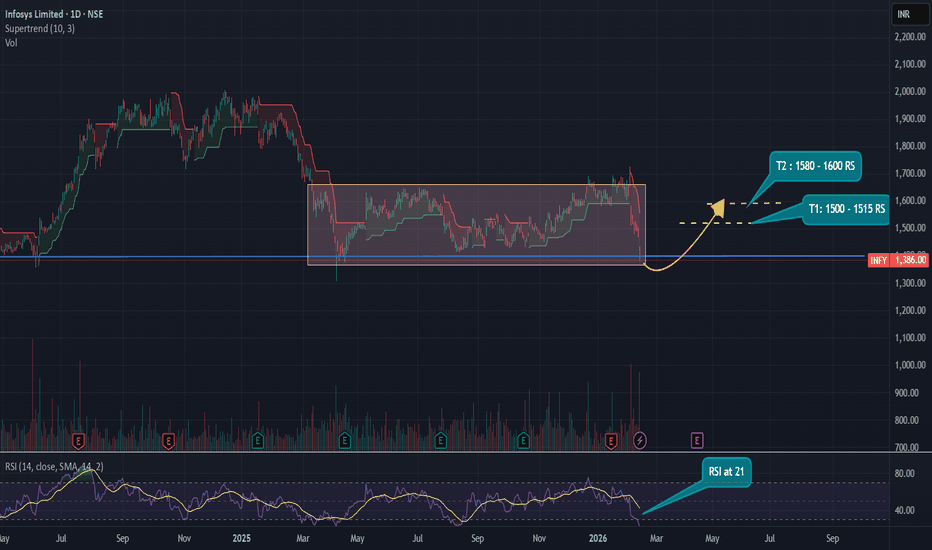

Infosys LimitedInfosys Technical Outlook :

Infosys has been consolidating within the ₹1400–₹1700 range over the past year. Currently, the stock is in the oversold zone, with the RSI at 21, and is testing a strong support level around ₹1400.

From a mid-term perspective, the setup looks attractive:

- Target 1: ₹1500

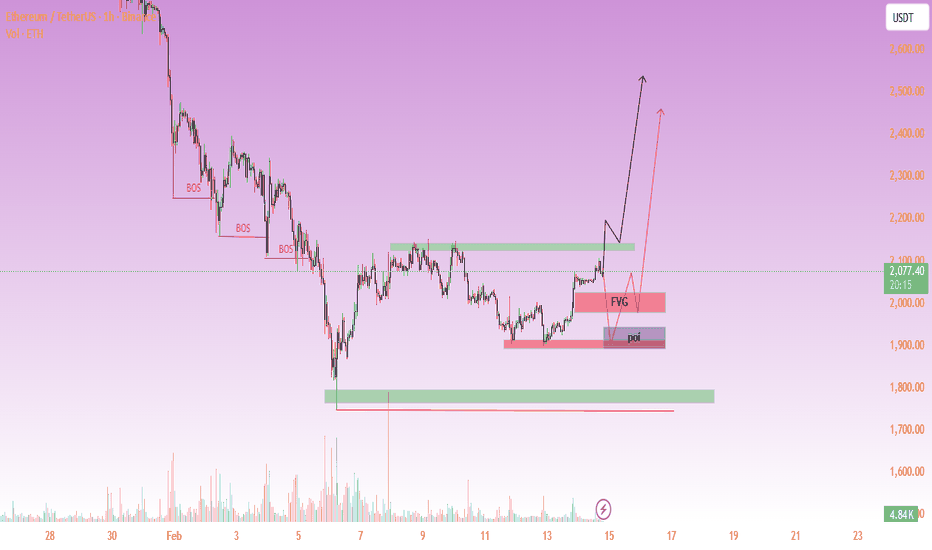

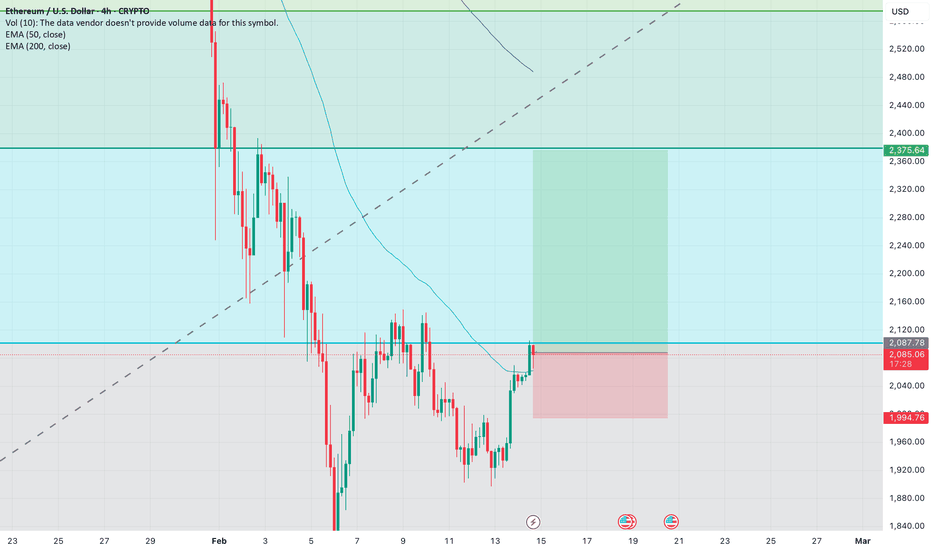

$ETH has officially lost the 2000–2020 base CRYPTOCAP:ETH has officially lost the 2000–2020 base we highlighted on the 1H chart.

Triple-top rejection (Top 1 → Top 2 → Top 3) played out perfectly — buyers failed at the 2140–2160 supply zone, and breakdown followed.

📍 First reaction target (1980–1950) ✅ Hit

That’s roughly a 2.6–3% move from

Hindustan Unilever : Prepared for Upside Hindustan Unilever – Failed Head & Shoulders Turning Bullish (Daily Chart)

On the daily timeframe, Hindustan Unilever was forming a well-structured Head & Shoulders pattern. The left shoulder, head, and right shoulder were clearly visible, with a defined neckline acting as support.

However, instea

SBILIFE: "Change of Character" Signaling somethingThe Technical Breakdown (Educational Guide)

The chart displays a beautiful confluence of Smart Money Concepts (SMC) and Fibonacci retracement. If you’ve been looking for a textbook "Buy the Dip" setup, this is it! Here are 4 key educational points from this chart:

1. The Choch (Change of Character)

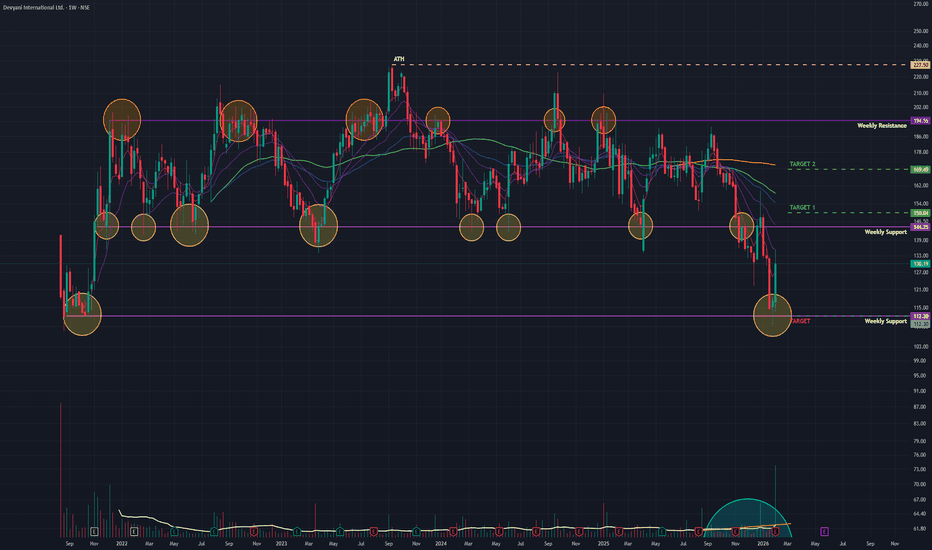

Devyani Int (W): Aggressive Bullish, Turnaround at Major Support(Timeframe: Weekly | Scale: Logarithmic)

The stock has confirmed a major "V-Shape Reversal" from its long-term support zone of ₹110. The surge is backed by "Climax Volume" and a positive reception to its Q3 operational updates, signaling that the 2-year correction might be over.

🚀 1. The Fund

See all editors' picks ideas

Peak Trading Activity Graphs [LuxAlgo]The Peak Trading Activity Graphs displays four graphs that allow traders to see at a glance the times of the highest and lowest volume and volatility for any month, day of the month, day of the week, or hour of the day. By default, it plots the median values of the selected data for each period. T

Smart Trader, Episode 03, by Ata Sabanci, Candles and TradelinesA volume-based multi-block analysis system designed for educational purposes. This indicator helps traders understand their current market situation through aggregated block analysis, volumetric calculations, trend detection, and an AI-style narrative engine.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Asset Drift ModelThis Asset Drift Model is a statistical tool designed to detect whether an asset exhibits a systematic directional tendency in its historical returns. Unlike traditional momentum indicators that react to price movements, this indicator performs a formal hypothesis test to determine if the observed d

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

See all indicators and strategies

Community trends

INDUS TOWER ANALYSISTHIS IS MY CHART OF THE WEEK PICK

FOR LEARNING PURPOSE

INDUS TOWER- The current price of INDUS TOWER is 466.60 rupees

I am going to buy this stock because of the reasons as follows-

1. It is making a new high by breaking the resistance of last 9 years ( we often call this Multi year brea

TVSSCS: Trendline Breakout Post Strong Q3FY26, Chart of the WeekTVS Supply Chain Solutions Just Broke Out on 12x Volume After Hitting Rock Bottom; Technical Reversal Meets a ₹6,300 Crore Order Pipeline. This Breakout Could Define TVS Supply's Next 12 Months. Let's Understand in "Chart of the Week"

As per the Latest SEBI Mandate, this isn't a Trading/Investm

BUY TODAY SELL TOMORROW for 5% DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed t

SW Solar - Bottom FishingCMP 195 on 14.02.26

As can be seen on the chart. There has been a big correction in the stock price in the past months. Presently trading near the lowest prices. If a reversal takes place, may go into a bullish phase ahead.

Possible targets may be 250/450.

The setup fails if it sustains below 170.

Avanti Feeds Limited - Breakout Setup, Move is ON...#AVANTIFEED trading above Resistance of 1199

Next Resistance is at 2118

Support is at 880

Here is previous chart:

Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

VBL – Is their a wedge Breakout- swing trade Scenario...???Varun Beverages Limited;- CMP: 493.80; RSI: 54.95

Trading plan based on the weekly chart of Varun Beverages Limited 🔍Visible Chart Patterns are as belwo

1️⃣ Falling Wedge / Descending Channel

Lower highs + flat to slightly rising lows

This is a bullish reversal / continuation pattern

2️⃣ Base

Can Jupiter's transit give a big move to Godrej Properties?Friends, trading on time cycle charts, especially long-term ones, is beyond imagination! Let me share a chart with you. This is the weekly chart of Godrej Properties. In this chart, I'll try to illustrate how much returns it has generated each time the cycle is in an uptrend. Let's get started.

Fri

See all stocks ideas

Feb 17

AGSTRAAGS Transact Technologies Ltd.

Actual

—

Estimate

—

Feb 19

CIEINDIACIE Automotive India Ltd

Actual

—

Estimate

5.40

INR

Feb 19

VESUVIUSVesuvius India Ltd

Actual

—

Estimate

—

Feb 19

ABBABB India Limited

Actual

—

Estimate

20.78

INR

Feb 19

SANOFICONRSanofi Consumer Healthcare India Limited

Actual

—

Estimate

—

Feb 24

SCHAEFFLERSchaeffler India Ltd

Actual

—

Estimate

19.40

INR

Feb 25

FLFLFuture Lifestyle Fashions Ltd.

Actual

—

Estimate

—

Feb 26

KSBKSB Ltd.

Actual

—

Estimate

4.40

INR

See more events

Community trends

BTC Reversal or still bearish (13/02/2026).BTC is trading in a parallel channel.

Major Trend :- Bearish

Minor Trend :- Range Bound.

A bearish scalp trade can be taken upto the support levels of the channel. With a SL being a candle closing above the channel.

If there are halt candle near the resistance levels and a BO occurs, a 1000 point

ETHUSDT – Potential Bullish Reversal From Discount Zone🧠 Market Structure

ETH has been trading in a clear bearish market structure, confirmed by multiple Breaks of Structure (BOS) to the downside.

Recently, price printed a short-term higher low, suggesting potential early accumulation and a shift toward internal bullish momentum.

Currently, price is a

Range Accumulation After Sell-Off, Bullish Breakout in ProgressMarket Overview

On the 1H timeframe, BTCUSD shows a clear transition from a strong bearish impulse into a structured accumulation phase, followed by an early-stage bullish breakout attempt.

Phase 1: Distribution & Breakdown

Price formed a distribution range near the 76,000–78,000 zone.

Multiple

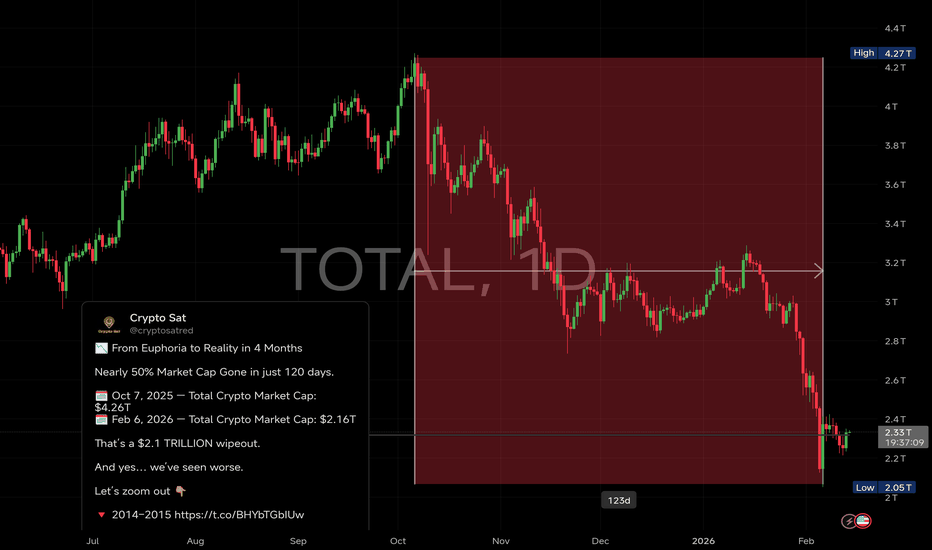

Nearly 50% Market Cap Gone in just 120 days📉 From Euphoria to Reality in 4 Months

Nearly 50% Market Cap Gone in just 120 days.

🗓 Oct 7, 2025 — Total Crypto Market Cap: $4.26T

🗓 Feb 6, 2026 — Total Crypto Market Cap: $2.16T

That’s a $2.1 TRILLION wipeout.

And yes… we’ve seen worse.

Let’s zoom out 👇

🔻 2014–2015 Bear Market

• Market cap

Analysis – Demand Zone Bounce Toward Key Resistance🔎 Market Overview

On the 1-hour timeframe, BTCUSDT (Bybit) shows a strong bullish reaction after forming a short-term bottom near the 65,000 area. Price has broken structure to the upside and is now consolidating above a marked demand zone, suggesting buyers are in control for the short term.

🟢 Key

ETH on to the reversal.Hey folks,

I am seeing 4h TF of ETH. the coin is testing the price of 2100 from a quite time now.

50EMA support can be noticed now on the current 4hr candle. i.e after the downward rally ended first time 4h tf candle closed above 50ema.

there is a potential reversal to the true value of ETH soo

See all crypto ideas

SILVER 1HRSWING TRADE

SILVER (XAGUSD) Looking good for Downside..

When it break level 73.77 and sustain.. it will go Downside...

SELL @ 73.77

Target

1st 63.89

2nd 56.48

Enjoy trading traders.. Keep add this STOCK in your watch list..

Big Investor are welcome..

Like this Post??? Hit like button..!!!

Foll

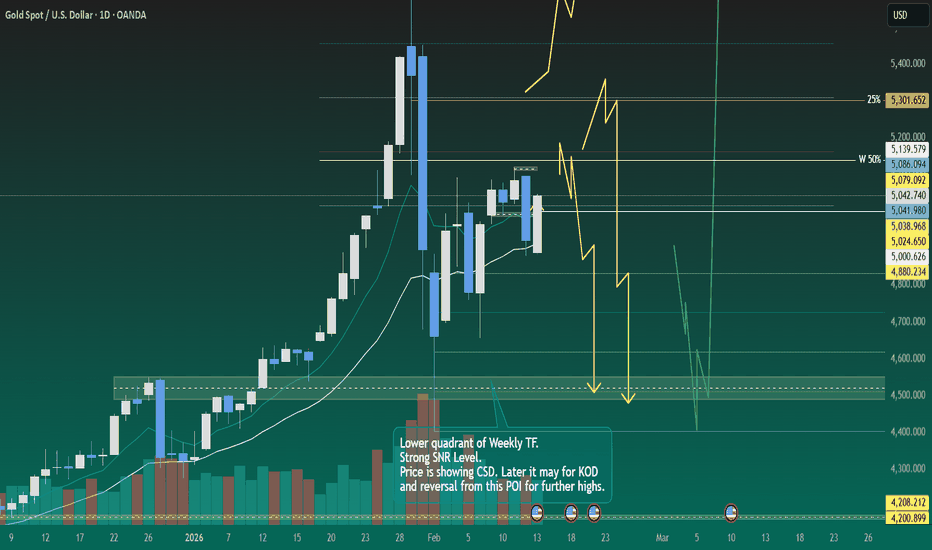

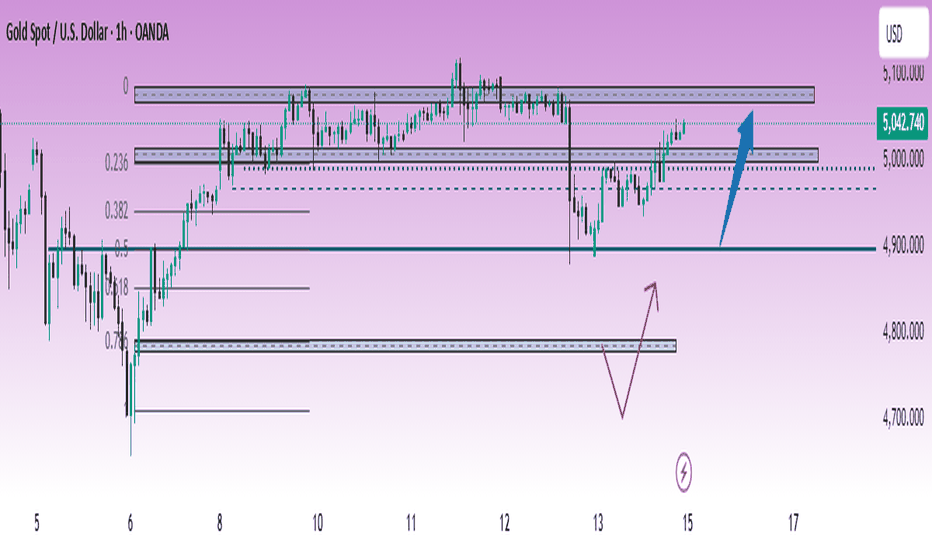

Weekly Analysis with buy/Sell scenarios in Gold/XAUUSD👋👋👋 Friends, What's your view on Gold???

Last week, global gold prices showed a volatile but upward bias, with spot gold recovering after a dip and ending the week with gains of roughly 1–2%, holding near the $5,000–$5,050 zone;

As per the current scenario we may further expect consolidation in t

XAUUSD – Weekly Outlook: Building LiquidityXAUUSD – Weekly Outlook: Liquidity Build Before Expansion? | Lana ✨

Gold is currently consolidating just below the 5,090–5,100 resistance zone after a sharp intraday recovery. The structure shows short-term strength, but price remains inside a broader range, suggesting liquidity is still being buil

XAUUSD (H1) – Weekly Outlook | LiquidityXAUUSD (H1) – Weekly Outlook | Liquidity Rebuild Before Expansion

Gold has recovered strongly from the sharp sell-off into 4,900 and is now rotating back toward the upper range. The current structure shows a classic liquidity rebuild phase after a stop run — and next week will likely decide whether

MCX Gold — Halt Complete. Expansion LoadingPrice: ~₹1,56,000

Structure: Impulse → Liquidity Flush → Higher Low → Compression

Gold did not reverse.

It reset.

The intraday chart shows a classic stop-hunt below ₹1,52,000 followed by aggressive absorption.

The daily chart confirms the 0.5 retracement at ₹1,48,470 held with precision. That leve

XAUUSD (4H) Analysis Price is compressing inside a triangle consolidation between rising support and descending resistance.

A strong breakout with candle close & sustain will likely trigger a high-momentum move.

👉 Break above resistance = bullish expansion

👉 Break below trendline = bearish continuation

Volatility load

“Gold Bullish Above 5090 – Key Levels Ahead”Right now, 5090 seems like a strong support for buyers. As long as price stays above this level, buying pressure can continue. Market structure is positive, and buyers are defending small dips around this zone.

If price holds above 5090 with good momentum, gold may move towards 5200, possibly today

Short Setup From Resistance to Support Overview

Timeframe: 45-minute

Instrument: Gold vs USD (XAU/USD)

The chart shows a recent strong bearish impulse (large red candle drop), followed by a rebound.

Price is now retracing upward into a previously established resistance zone.

2️⃣ Key Levels Identified

🟢 Resistance Zone: ~5,040 – 5,0

See all futures ideas

FOREX "PAIRS IN PLAY" Session 33 15 02 26Scanning multiple forex pairs to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial

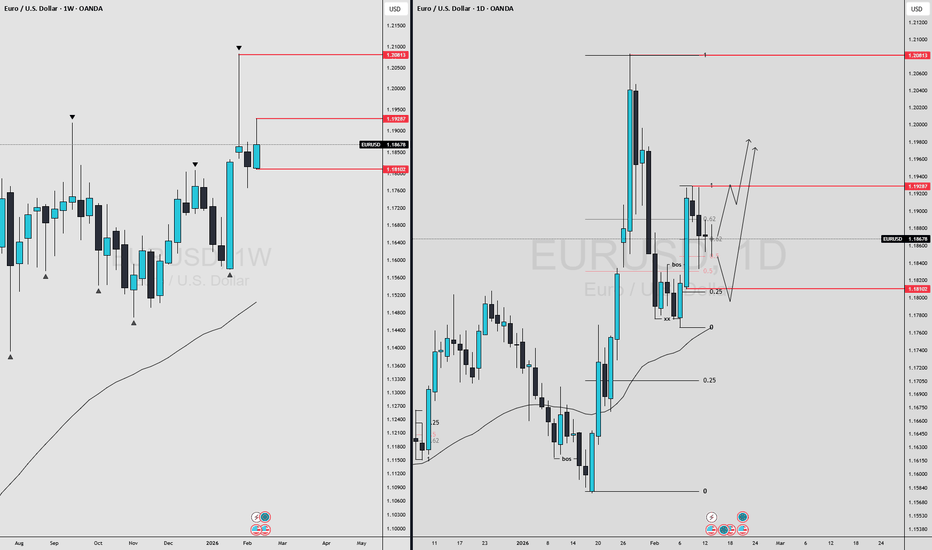

EURUSD BUY Breakout + Retest Entry

➡️ Break & Buy Above: 1.18956

When price decisively breaks above key resistance and holds, this signals bullish continuation.

📌 Stop-Loss: 1.1372

📌 Targets:

• TP1: 1.20888

• TP2: 1.21500

Why this works: Breakouts that retest previous resistance as support can unleash strong up moves.

AUDJPY – Bullish Reversal From Trendline SupportAUDJPY is reacting strongly from a major ascending trendline support on the 1H timeframe. Price swept liquidity below the structure, tapped into the demand zone, and immediately rejected — signaling buyer strength.

we entered long around 108.180, which aligns perfectly with the technicals.

📈 Why T

EURUSD - 4H - SHORTFOREXCOM:EURUSD

Hello traders , here is the full multi time frame analysis for this pair, let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied. wait for more Smart Money to develop before taking any pos

See all forex ideas

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.