Hindustan Unilever : Prepared for Upside Hindustan Unilever – Failed Head & Shoulders Turning Bullish (Daily Chart)

On the daily timeframe, Hindustan Unilever was forming a well-structured Head & Shoulders pattern. The left shoulder, head, and right shoulder were clearly visible, with a defined neckline acting as support.

However, instea

The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

SBILIFE: "Change of Character" Signaling somethingThe Technical Breakdown (Educational Guide)

The chart displays a beautiful confluence of Smart Money Concepts (SMC) and Fibonacci retracement. If you’ve been looking for a textbook "Buy the Dip" setup, this is it! Here are 4 key educational points from this chart:

1. The Choch (Change of Character)

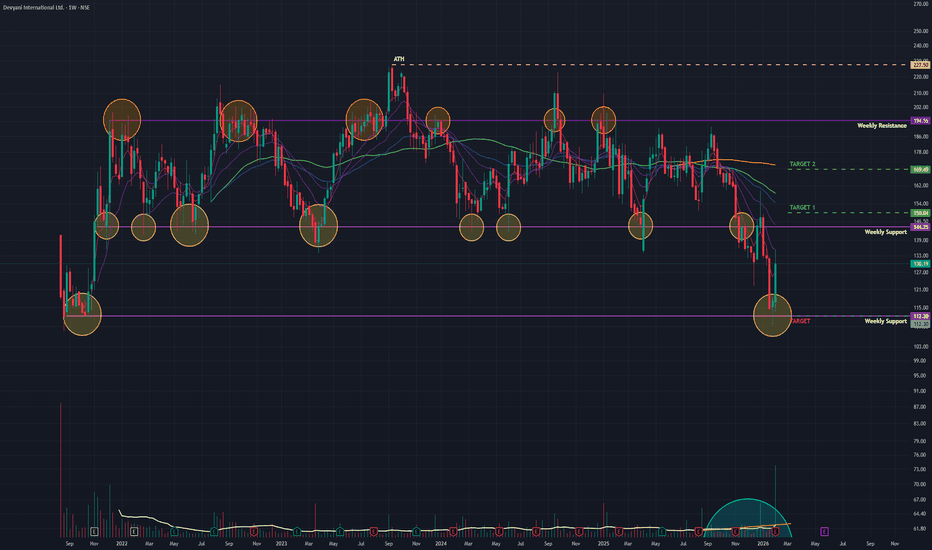

Devyani Int (W): Aggressive Bullish, Turnaround at Major Support(Timeframe: Weekly | Scale: Logarithmic)

The stock has confirmed a major "V-Shape Reversal" from its long-term support zone of ₹110. The surge is backed by "Climax Volume" and a positive reception to its Q3 operational updates, signaling that the 2-year correction might be over.

🚀 1. The Fund

Nykaa: Descending Trendline BreakoutNykaa respected the rising structure even during the correction and never lost its trend strength.

Price held the sloping support, absorbed selling pressure, and then gave a clean breakout above the key horizontal resistance around 277 with strong volume.

This move shows acceptance above resistanc

The crypto has found its supportBitcoin CMP $70690

The beauty of looking at various asset classes is that they rise and fall together. In my view the correction in the crypto is over.

Elliott- The v waves within the C wave is done. Hence to me this correction is over.

Fib- The crypto reversed just shy away from the 59K whic

NTPC.. Moved outside the channel..NTPC.. Trying its level best to move.

Selling pressure in market pulled it back and retested the support.

Now things can be interesting..

Moved above this channel then first target can be somewhere around 370, the exact level from where it faced resistance today..

Second can be somewhere around

Nifty Energy: Final Bounce Before the Deeper CorrectionThe Nifty Energy Index continues to trade within a higher-degree corrective structure rather than a fresh impulsive uptrend.

The decline from the highs appears to have completed Wave W, followed by an ongoing recovery in Wave X.

In the near term, the structure allows for one more upside phase . A

Dead Cat Bounce in Nifty? Heavyweights to Deliver The VerdictDead Cat Bounce in Nifty? Index Heavyweights to Deliver the Verdict Soon…

Both index heavyweights remain structurally weak despite the recent bounce.

On the daily timeframe, Reliance Industries and HDFC Bank have transitioned out of bullish Ichimoku regimes. Crucially, the second daily Kumo

Long term analysis of Tanla Platforms Ltd.Wrap up:-

As per chart of Tanla Platforms Ltd., it seems that correction in Tanla is over with a wxy pattern in major wave 2 and also, after breakout it has retested the support. Now, major wave 3 is about to start/started.

What I’m Watching for 🔍

As initial breakout is confirmed for a probabl

Understanding the Down Trend Line Breakout : Base chart GALLANTTUnderstanding the Down Trend Line Breakout : Base chart GALLANTT ISPAT Ltd

Introduction

Gallantt Ispat Limited, currently trading around 580.00 on its daily chart, has been moving below a persistent down trend line since August 2025. Recently, the stock has shown signs of strength by forming a doubl

See all editors' picks ideas

Smart Trader, Episode 03, by Ata Sabanci, Candles and TradelinesA volume-based multi-block analysis system designed for educational purposes. This indicator helps traders understand their current market situation through aggregated block analysis, volumetric calculations, trend detection, and an AI-style narrative engine.

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

Asset Drift ModelThis Asset Drift Model is a statistical tool designed to detect whether an asset exhibits a systematic directional tendency in its historical returns. Unlike traditional momentum indicators that react to price movements, this indicator performs a formal hypothesis test to determine if the observed d

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

See all indicators and strategies

Community trends

DIVISLAB : This Is Why Pattern Reading MattersThis is a hidden Inverse Head & Shoulders (IHNS) pattern forming near structure.

Price has already respected the neckline and higher lows are visible.

Such patterns usually appear before the crowd notices.

This is an early sign of strength, not a breakout chase.

Read the chart carefully — structur

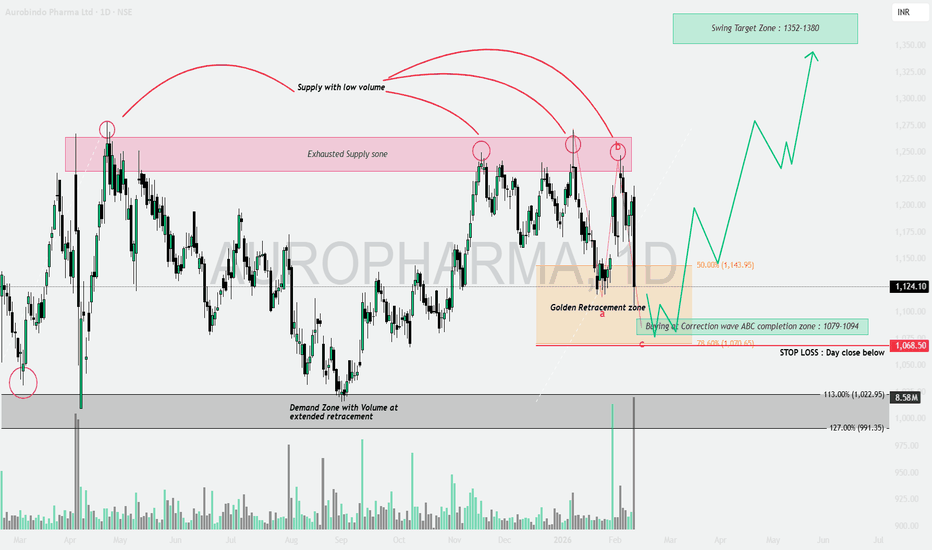

AUROPHARMA: Supply Exhaustion & The Golden Retracement📝 The Technical Breakdown (Educational Guide)

This chart is a masterclass in understanding Volume Price Analysis + Fibonacci Confluence. Let’s decode the setup through 4 key educational pillars:

1️⃣ Supply Exhaustion Zone 🔴

Observe the pink box marked as “Exhausted Supply Zone.”

Price has tested

M&M is looking good for 21% upside in next 5-6 MonthsM&M is looking good for 21% upside in next 5-6 Months

LTP - 3528

SL - 3280

Targets - 4300+

timeframe - 5-6 Months

Fundamentals:

Mahindra & Mahindra operates diverse businesses including Auto, Farm, Financial Services. It holds market leadership in SUVs and LCVs, is the #1 tractor manufacturer

BSE: Short-Term Consolidation Breakout Confirmed!Technical Analysis:

BSE has been trading within a defined range for an extended period, and the chart now indicates a clear short-term breakout, suggesting a shift in momentum.

Key Highlights:

• Breakout Zone: The price has started sustaining above the 2,800–2,850 consolidation zone, highlighted in

BUY TODAY SELL TOMORROW for 5% DON’T HAVE TIME TO MANAGE YOUR TRADES?

- Take BTST trades at 3:25 pm every day

- Try to exit by taking 4-7% profit of each trade

- SL can also be maintained as closing below the low of the breakout candle

Now, why do I prefer BTST over swing trades? The primary reason is that I have observed t

JSW STEEL - Cup and Handle - Daily The price formed a rounded bottom from November to early January, which is the cup. This shows gradual accumulation and exhaustion of selling pressure rather than panic selling.

After reaching the previous resistance zone near 1,240–1,250, the stock moved into a short, shallow pullback, forming the

Inox Wind: Decision Zone at 200-WMA — Bounce or Breakdown?Inox Wind is currently trading at an important technical zone, sitting near the 200-week moving average . This area often acts as long-term support, but it is not a guarantee of a reversal .

From a structural perspective, the broader move looks corrective , unfolding as a (W)-(X)-(Y) pattern .

BSE-Likely Cup &Handle Break outBSE:

Trading at 2881 and above all its critical Moving averages Viz10/20/50/10 DEMA

In daily chart has formed C&H Pattern,

Based on the pattern and price volume suggests -breaking the Neckline resistance at 2880-2900 likely to test 2950/3000+ shortly(For educational purpose only)

Cipla - Positional LongCMP 1342 on 11.02.26

All important levels are marked on the chart.

The range between 1280 and 1330 appears to be a support level. The price is sustaining and consolidating here. If it goes up. may go to the levels of 1425/1480/1550.

The setup fails if the price sustains below 1280-1270.

The above i

TORNTPOWER: Analyzing the 1489-1509Since October 2025, TORNTPOWER has been on a sustained bullish trajectory, consistently forming higher highs. This momentum reached a boiling point today, February 10, 2026, as the stock surged over 4% to test a historically significant supply zone.

Surging Profits: Torrent Power reported a massive

See all stocks ideas

Today

MANINFRAMan Infraconstruction Limited

Actual

—

Estimate

—

Today

ULTRAMARUltramarine & Pigments Limited

Actual

—

Estimate

—

Today

YATRAYatra Online Limited

Actual

—

Estimate

1.14

INR

Today

BECTORFOODMrs. Bector's Food Specialities Ltd.

Actual

—

Estimate

1.20

INR

Today

TBOTEKTBO Tek Ltd.

Actual

—

Estimate

5.82

INR

Today

EASEMYTRIPEasy Trip Planners Ltd.

Actual

—

Estimate

—

Today

SURYAROSNISurya Roshni Limited

Actual

—

Estimate

5.30

INR

Today

FIEMINDFiem Industries Limited

Actual

—

Estimate

24.30

INR

See more events

Community trends

BTC 1H🧠 Market Context

Bitcoin has just completed a liquidity sweep after an extended move, tapping into a high-timeframe supply/demand reaction zone. Price action is currently compressing, signaling that we’re approaching a decision point where momentum traders and HTF participants collide.

The recent

Bitcoin Bybit chart analysis FEBURARY 9Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

There are no separate Nasdaq indicators.

When the re

BTCUSDT.P – Elliott Wave AnalysisSHORT-TERM TRADE PLAN AS PER ELLIOTT WAVE ANALYSIS:

💰 Current Price: ~67230

🔻 Scenario 1 (Downside):

- 🛒 Buying interest may emerge at Intermediate Wave 2/B Support Zone → 62127 – 63890

- 📉 If deeper correction → Major Wave C Support Zone → 48412 – 53325

🔺 Scenario 2 (Upside):

- ⚠️ Selling p

Analysis BTCUSD (1H Chart): Analysis BTCUSD (1H Chart):

- Prices have breached the bearish flag pattern on the downside, confirming weakness in the structure.

- Although the prices are testing iFVG (strong support) and the market has entered the oversold zone, which may trigger a minor pullback, the broader trend remains b

$ETH has officially lost the 2000–2020 base CRYPTOCAP:ETH has officially lost the 2000–2020 base we highlighted on the 1H chart.

Triple-top rejection (Top 1 → Top 2 → Top 3) played out perfectly — buyers failed at the 2140–2160 supply zone, and breakdown followed.

📍 First reaction target (1980–1950) ✅ Hit

That’s roughly a 2.6–3% move from

$ZRO Dropped 84% But What's Coming Next Could Shock Everyone CSE:ZRO Dropped 84% But What's Coming Next Could Shock Everyone 🚀

#ZRO Has Corrected ~84% Inside A Multi-Month Descending Channel Since 2024, Now Testing The HTF Breakout Level.

Price Is Compressing At Channel Resistance With Strong Accumulation Around $1.50–$1.20 👇

✅ Strong HTF Demand: $1.50–$1.

XAUUSD GOLD Analysis on (11 Feb 2026)#XAUUSD UPDATEDE

Current price - 5054

If price stay above 5015,then next target 5080 and 5110 and below that 4970

Plan1;If price break 5040-5050 area,and stay above 5050 we will placed buy order in gold with target of 5080 and 5110 & stop loss should be placed at 5115

See all crypto ideas

Gold Price Update: Trendline Breakout with Clear Risk DefindGold has broken above the falling trendline, and this move is important not because of one candle, but because of the change in structure. After a prolonged corrective phase, price is now holding above the breakout level, which signals that buyers are starting to step in.

What I like about this set

XAUUSD Price View with Supply, Demand and Risk ZonesGold price action shows a controlled recovery after a strong bearish move. Earlier, price found solid buying support in the demand zone around 4,650–4,700, where selling pressure reduced and the market stabilised. This zone remains an important support and a key area to watch if price moves lower ag

We’re looking at Gold vs USD on the 1-hour chartPrice recently completed a deep pullback after a strong bullish leg.

That pullback formed a rounded / cyclical bottom (purple curve), which often signals trend continuation, not reversal.

🧠 Structure & Price Action

What stands out:

Higher low formed after the sell-off → bullish market structure

Pullback Into Resistance, Sell-the-Rally Setup

Market Structure

Overall structure is bearish-to-range after a strong selloff.

Price made a rounded bottom from the Feb lows, then transitioned into a corrective rally.

The rally is retracing into a prior supply / resistance zone, not breaking structure yet.

Key Zones

Major Resistance / Supply

XAUUSD/GOLD 1H BUY PROJECTION 10.02.26First, look at the market structure.

We can clearly see a Head and Shoulders pattern forming on the one-hour timeframe.

This is the left shoulder,

this is the head,

and now price is forming the right shoulder.

At the same time, the market has printed an Evening Star candlestick pattern near the to

Gold Trading Strategy for 10th February 2026📊 Intraday Trading Plan – Breakout Strategy (1-Hour Candle)

This strategy is based on 1-hour candle confirmation. Trades should be taken only after candle close, not during formation.

🔼 BUY SETUP (Bullish Breakout)

🟢 Condition:

Buy ABOVE the HIGH of the 1-hour candle

Candle must close above 510

Gold 4H, Concept to long trades.This chart documents multiple long executions, where most TP levels were systematically captured.

Entries were executed using scaled lot sizing ranging from 0.01 to 0.10, allowing partial position management and reduced drawdown.

The primary setup is a pennant continuation pattern, confirmed by st

XAGUSD - Parallel ChannelThe price of silver has already borken out from this parallel channel that it was trading inside for the past few days. If the Bullish momentum continues, expect to have quick pullback to approx $74-$75 before continuing the next leg up. Also the RSI has now returned to neutral territoriy, which wou

See all futures ideas

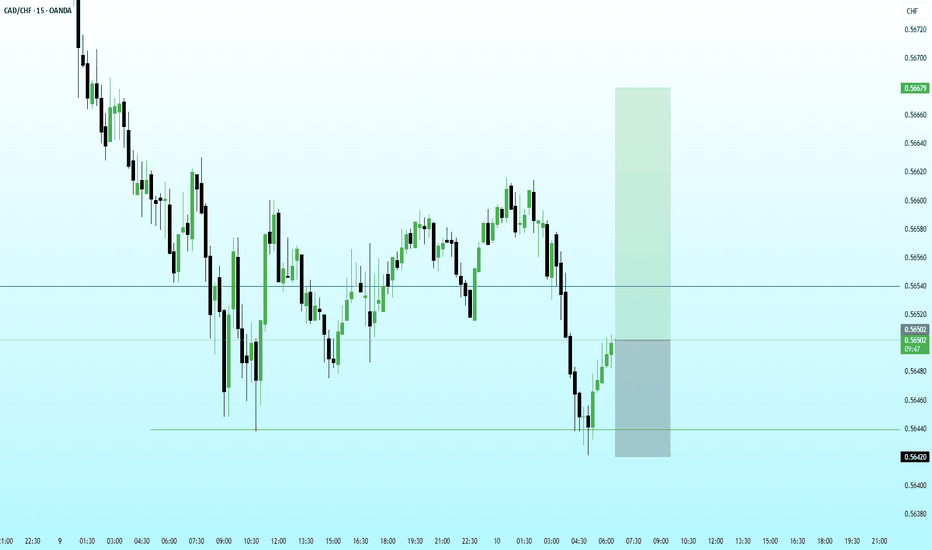

CADCHF-M15CAD/CHF has delivered a textbook sell-side liquidity raid beneath the Asian range, purging weak longs before staging an aggressive displacement higher. The reaction from the discount array suggests deliberate smart money activity, with price repricing toward equilibrium after leaving a clear imbalan

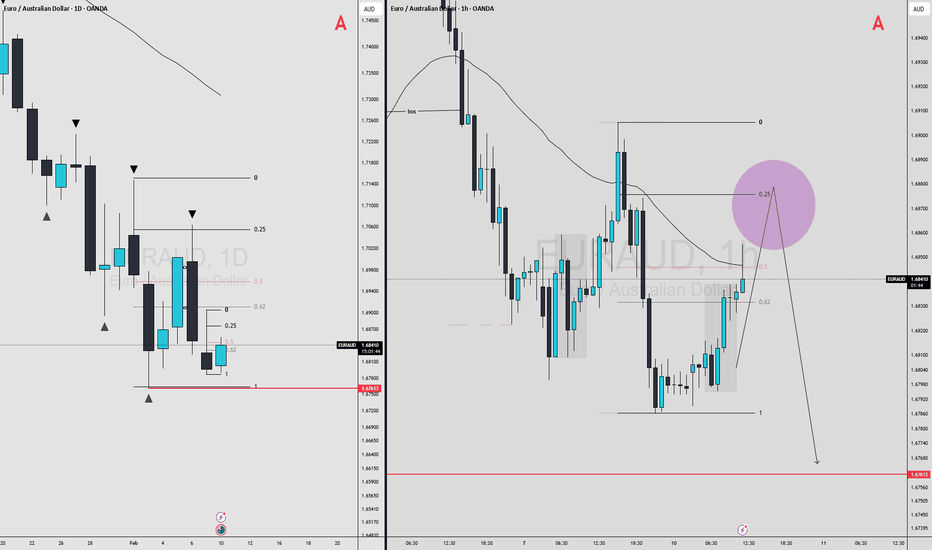

EURAUD MULTI TIMEFRAME ANALYSIS Scanning multiple forex pairs to filter high-quality trade setups. No trades are forced—only structure-based opportunities.

Note: There may be a delay in this video due to upload processing time.

Disclaimer: FX trading involves high leverage and substantial risk, and losses can exceed your initial

Usdjpy expecting Buyside delivery Price clean up the current Feb monthly liquidity, and reached at Major price from where the buyside delivery begins, expecting some reactions from here ....

Incase if it fails to give reaction then I will be looking later once it came back to structure again at same zone area !! I will only execute

GBPUSD Analysis on (11 Feb 2026)GBPUSD UPDATEDE

Current price - 1.36450

If price stay above 1.36150,then next target 1.36800 and 1.37000 and below that 1.36000

Plan; if price break 1.36400-1.36450 area and above that 1.36450 area,we will place buy oder in GBPUSD with target of 1.36800 and 1.37000 & stop loss should be placed at

AUDJPY Hourly 1:4 RRAs AUDJPY is in Uptrend

my idea to trade is mentioned in Chart

entry point OB rest at equilibrium of Dealing range

i will only enter after conformation of lower time frame (Upside Choch) in either one or five minutes

if it played well will get 1:4 RR Trade

#Forex #AUDJPY #FXtrade

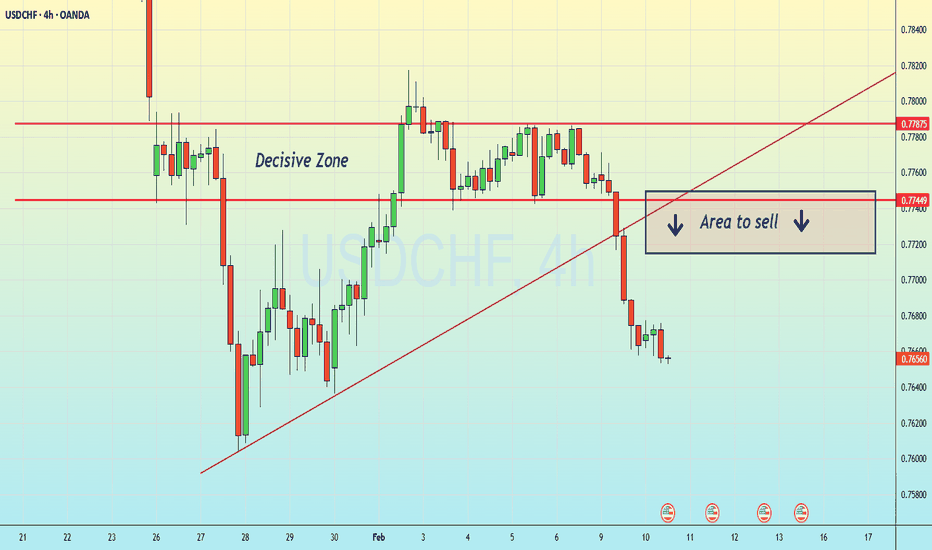

USDCHF Is Not Weak – It’s Testing Support!USD/CHF is currently trading inside a well-defined rising channel, and the recent move lower looks more like a pullback into trend support rather than a breakdown.

For me, this is typical behavior in trending markets. Strong moves don’t continue in a straight line, price pulls back, tests support,

See all forex ideas

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.