The best trades require research, then commitment.

Get started for free$0 forever, no credit card needed

Scott "Kidd" PoteetPolaris Dawn astronaut

Where the world does markets

Join 100 million traders and investors taking the future into their own hands.

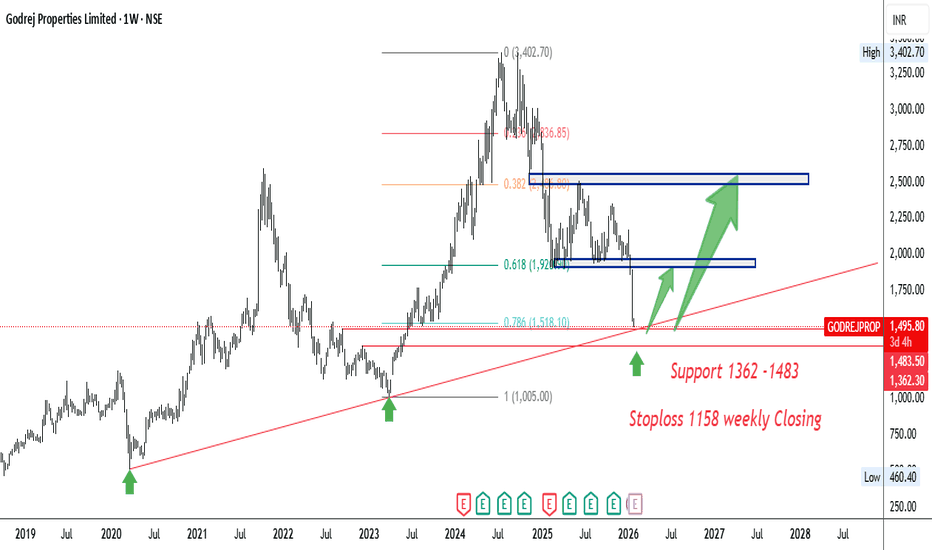

IBEX ltd analysisJAN-2025

1. has got good move and then time correction.

2. Volume is contracting.

3. good momentum score, Good durabilty score.

2. quaterly profit & revenue has increased.

3. EPS has increased.

4. Debt has gone down.has low debt

5. No change in institution holding.

i am managing my risk by stop los

AXISBANK 40% upside possibility in 1-1.5 YearsAXISBANK 40% upside possibility in 1-1.5 Years

Fundamentals - Company has delivered good profit growth of 72.2% CAGR over last 5 years - Best among all Private banks.

Technical - Stock breaking from ATH backed with excellent Results.

LTP - 1325

Targets - 1850+

Timeframe - 1-1.5 Years.

Happy In

TATACONSUMER | Daily TF – RISING WEDGE BreakdownTATACONSUMER is showing short-term weakness after breaking below the rising trendline and failing to hold above 1160.

As long as price stays below this level, the probability increases for a move towards 1120–1100, which aligns with a higher time-frame Bullish Order Block (Demand Zone) and Fibonacc

Canara Bank daily chartThe chart pattern Upward Parallel channel is seen .

Price is hovering around 20 and 50 EMA. Near term (next few days): Expect consolidation around 150–156.

A breakout above 156.80 could target 160–162, while a drop below 150 might lead to testing 148.

Key levels:

Support: 150 / 148.

Resistance:

UJJIVANSFB: Testing IPO High with Triple Top, Chart of the MonthFrom IPO Highs to Recovery: Is Ujjivan Small Finance Bank Finally Breaking Out After Six Years? After Posting Robust Q3 FY26 Numbers with asset quality improving and Micro Finance Cycle Turning Back. Let's Analyze in "Chart of the Month"

As per the Latest SEBI Mandate, this isn't a Trading/Inves

Bandhan Bank | Long-Term Downtrend | Decision ZoneBandhan Bank continues to trade inside a long-term falling channel, with price now near the lower boundary / support zone (~₹140–150).

This area is critical as it may act as either a base or a breakdown trigger.

🔍 Technical View:

• Strong descending channel intact

• Series of lower highs & lower lo

SILVER (XAGUSD) – Weekly Projection Analysis (24-01-26)

Overall Bias: 🔥 Strong Bullish

🔹 Market Structure

Price is clearly inside a bullish channel

Previous trendline break → clean retest

Retest aligns perfectly with 50% Fibonacci level

👉 This is a high-probability continuation zone

🔹 Key Levels

Support S2: ~96

Support S1: ~99–100

Entry Zone: Br

See all editors' picks ideas

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

Volatility Risk PremiumTHE INSURANCE PREMIUM OF THE STOCK MARKET

Every day, millions of investors face a fundamental question that has puzzled economists for decades: how much should protection against market crashes cost? The answer lies in a phenomenon called the Volatility Risk Premium, and understanding it may fundam

Volume Gaps & Imbalances (Zeiierman)█ Overview

Volume Gaps & Imbalances (Zeiierman) is an advanced market-structure and order-flow visualizer that maps where the market traded, where it did not, and how buyer-vs-seller pressure accumulated across the entire price range.

The core of the indicator is a price-by-price volume prof

Match Finder [theUltimator5]Match Finder is the dating app of indicators. It takes your current ticker and finds the most compatible match over a recent time period. The match may not be Mr. right, but it is Mr. right now. It doesn't forecast future connection, but it tells you current compatibility for today.

Jokes aside,

See all indicators and strategies

Community trends

AXISBANK 40% upside possibility in 1-1.5 YearsAXISBANK 40% upside possibility in 1-1.5 Years

Fundamentals - Company has delivered good profit growth of 72.2% CAGR over last 5 years - Best among all Private banks.

Technical - Stock breaking from ATH backed with excellent Results.

LTP - 1325

Targets - 1850+

Timeframe - 1-1.5 Years.

Happy In

HDFCBANK Lead the Pre-Budget Rally - Lead Turnover Stock HDFCBANK Lead Turnover Stock Level analysis for 28th JAN 2026

Lead the Pre-Budget Rally.

👇🏼Screenshot: All-day (27th Jan 2026) in 5 min TF..

💥Level Interpretation / description:

L#1: If the candle crossed & stays above the “Buy Gen”, it is treated / considered as Bullish bias.

L#2: Possibi

Hindalco Industries Ltd Stock price will hit 1020-1035Hindalco Industries Ltd is well-positioned for a short-term long trade at ₹962, supported by favorable price and volume action. The setup indicates upside potential toward the ₹1,020–1,035 zone in the near term, making current levels an attractive entry for short-term traders.

TechM - Multi time frame analysisThe price has broken the resistance at the 1560 - 1580 zone, unable to sustain, fall back and once again took support. Today's movement shows bullish strength.

As per the daily chart, the price has broken the trend line. Strong weekly close will confirm the bullish movement.

Buy above the 1595 - 16

Bullish pennant HindCopperStrong uptrend. Price is consolidating just below resistance (~₹565–570). This looks like a healthy pause after a sharp rally. Expectation: a breakout above ₹570 can lead to a fast move higher; downside remains limited as long as ~₹545 holds.

Next possible targets (on upside):

₹620–630 → first imme

NSE: EMCURE - Ready for take off?EMCURE is trading near its resistance in Daily/Weekly Timeframe. Last candle shows clear absorption of sellers near the resistance zone. If it comfortably closes above 1600, then it might give a big move. Wait for the confirmation before making a move.

This is not an Investment advice.

Kitex (W): Aggressive Bullish, Political Catalyst + Tech Rev(Timeframe: Weekly | Scale: Logarithmic)

The stock has staged a V-Shape Reversal from a fresh 52-week low, forming a textbook Bullish Hammer on the weekly chart. This technical move is powered by a major political development (joining NDA), which removes significant "Political Risk" from the s

See all stocks ideas

Jan 27

ASIANPAINTAsian Paints Ltd.

Actual

11.05

INR

Estimate

12.33

INR

Today

ECLERXeClerx Services Limited

Actual

—

Estimate

39.18

INR

Today

GVT&DGE Vernova T&D India Limited

Actual

—

Estimate

10.43

INR

Today

LTFOODSLT Foods Limited

Actual

—

Estimate

5.11

INR

Today

VGUARDV-Guard Industries Limited

Actual

—

Estimate

1.40

INR

Today

SBILIFESBI Life Insurance Co. Ltd.

Actual

—

Estimate

6.94

INR

Today

M&MFINMahindra & Mahindra Financial Services Ltd.

Actual

—

Estimate

5.39

INR

Today

CARTRADECarTrade Tech Ltd.

Actual

—

Estimate

13.86

INR

See more events

Community trends

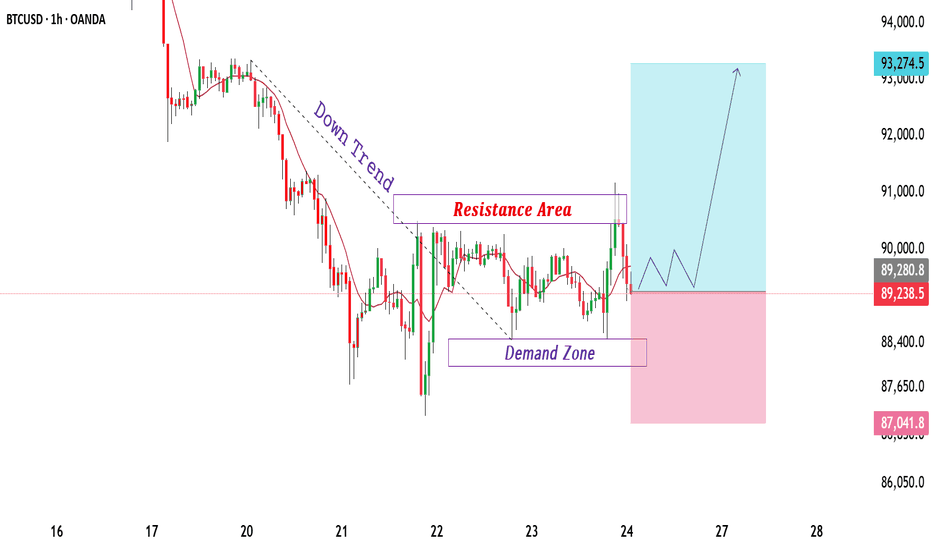

Bitcoin at Demand: Where Most Traders Panic and Smart Money WaitWhen I look at this chart, I don’t see weakness.

I see price reacting exactly where it should .

Bitcoin is sitting above a clearly defined demand zone, and instead of collapsing, price is slowing down and compressing.

That usually tells me the market is absorbing liquidity, not distributing .

K

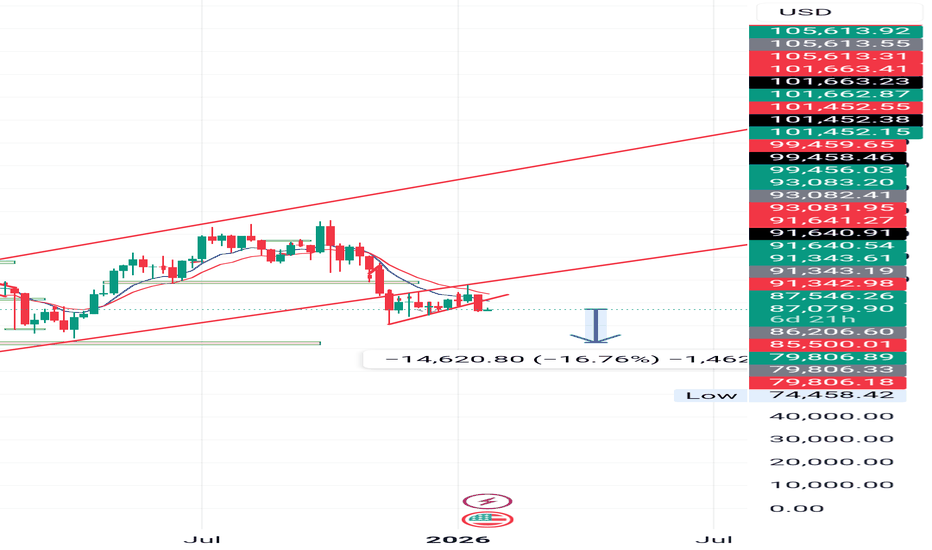

BTC Confirms Bearish Structure After Neckline RejectionBTC Confirms Bearish Structure After Neckline Rejection

#Bitcoin has rejected the 94k–98k neckline resistance, confirming a bearish market structure.

➡️ Resistance: 94k–98k

➡️ Supports: 80k → 75k → 70k

Structure shows a confirmed Head & Shoulders Pattern Failed, Followed by a bear flag breakdown,

Bitcoin Bybit chart analysis JENUARY 27Hello

It's a Bitcoin Guide.

If you "follow"

You can receive real-time movement paths and comment notifications on major sections.

If my analysis was helpful,

Please click the booster button at the bottom.

This is a Bitcoin 30-minute chart.

Shortly, there's a Nasdaq indicator release at 12:00 P

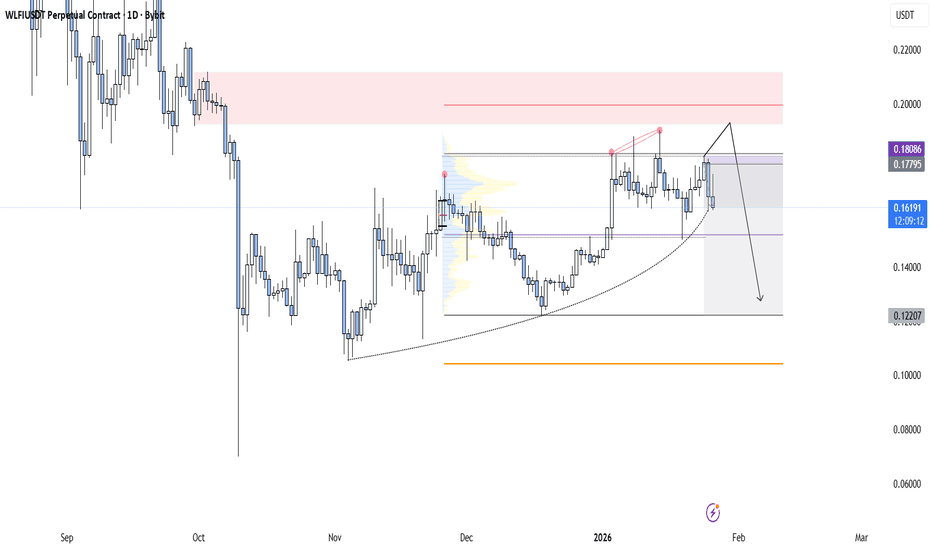

BTCUSD Trades Between Demand and Resistance Bearish Structure.BTCUSD is currently trading within a corrective structure after a strong bearish move, clearly respecting a descending trend. Price action shows lower highs and lower lows, confirming short-term bearish control. The marked resistance area near 90,800–91,200 has acted as a selling zone where price pr

See all crypto ideas

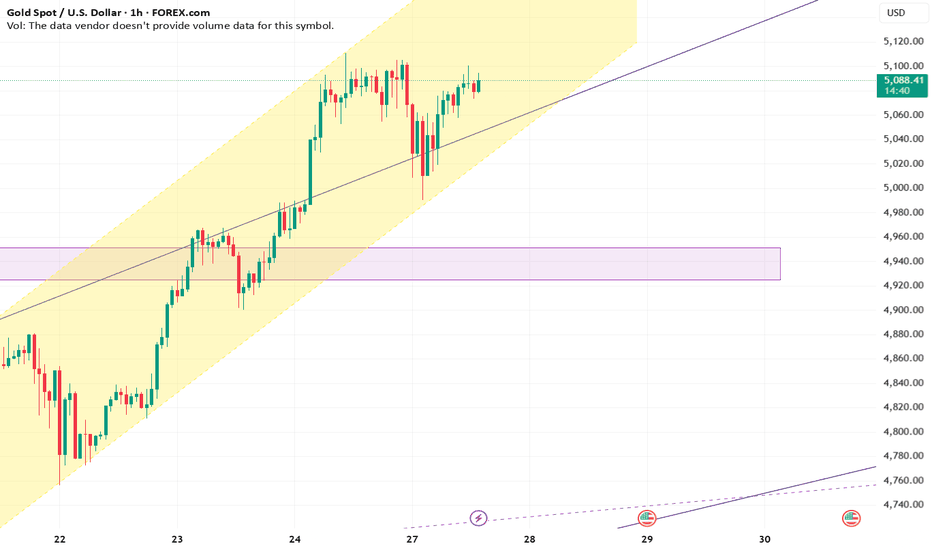

Gold 5200/1h ChartGold moving in channel from last 10 days. I believe breaking the 5110 level will put gold to new high of 5200. Although I don't see this happing today. Failing to do so might trigger a profit booking as it has already moved 15% from previous high (+last 7 days green candle closing).

Be vigilant wit

Elliott Wave Analysis – XAUUSD | 27/01/2026

1. Momentum

Daily (D1)

– D1 momentum is currently compressing. This indicates that bullish pressure is still present; however, momentum has weakened, so a potential reversal risk exists.

→ The broader trend remains bullish, but strong corrective moves should be treated with caution.

H4

– H4 momen

XAUUSD SELLAccording to the current conditions, gold may fall downwards. You can short gold after receiving LTF confirmation. People have bought it in a hurry, and gold will only make a new ATH after their stop losses are taken. What I'm saying isn't 100% accurate, but I'm sharing my experience. You should c

XAUUSD – Brian | H3 Technical AnalysisGold has officially broken above the 5,000 level for the first time, confirming a major structural shift on higher timeframes. The breakout reinforces the broader bullish narrative, with price now trading firmly in expansion mode rather than consolidation.

The move above 5,000 reflects sustained sa

Silve is going to moon higher speed than GOLD #xauusdSilve is going to moon higher speed than GOLD #xauusd and this is my next move i analysis from 50 to 100 then 91 to 114 and form next level to next tp of silver as i analysis as of now it takes time and in between a small correction will be possible and then ne xt tp hits of #xagusd

Silve is goin

Gold Trading Strategy for 27th January 2026🟡 GOLD INTRADAY TRADE SETUP (15-MIN TIMEFRAME)

📈 BUY SETUP (Bullish Scenario)

🟢 Buy only if price breaks and closes ABOVE the 15-minute candle high

🔹 Entry Condition:

➡️ Buy Above: 5088

➡️ 15-min candle must close above 5088

🎯 Targets:

🎯 Target 1: 5099 💰

🎯 Target 2: 5110 💰💰

🎯 Target 3: 5125 💰💰💰

XAUUSD – Bullish Continuation, ATH Expansion Still in PlayGold continues to trade within a strong bullish channel, maintaining its ATH expansion structure. The recent pullback is corrective in nature and shows clear signs of liquidity absorption rather than distribution.

On the macro side, sustained USD weakness, safe-haven flows, and a still-cautious Fed

CRUDE OIL Moving towards 6700+CRUDE OIL Moving towards 6700+ after 5 Years ... Are we near the breakout of CRUDEOIL?

Crude OIL MCX is seen rising towards 6700+ Level post correction for 5 Months.

We seen big Rally in 2020-2021 on Crude OIL post COVID - post that we have seen 4 Years of correction on it. Now are we ready for up

See all futures ideas

GBPUSD – Support Holding, Watching Reaction From RangeGBP/USD has reacted from a well-defined support zone, an area where buyers have stepped in multiple times before. Price is currently trading between clear support and resistance, indicating a short-term range environment.

As long as this support holds, upside reactions toward the resistance zone re

USDINR at Key Resistance – Break or Rejection?USDINR is currently trading near the upper boundary of a well-defined rising channel — a zone where price has historically faced strong rejection and profit booking.

This rally has been structural, not random. Price has respected the channel multiple times, creating higher highs and higher lows, sh

GBP/AUD: Corrective Rally, Downtrend IntactGBP/AUD is trading in a clear bearish Elliott Wave structure on the 4H timeframe. The market has already completed a strong impulsive decline and is currently moving in a Wave 4 corrective pullback, which is happening inside a downward channel and near key Fibonacci retracement levels. This correcti

USDCHF trading above Decisive zoneThe USDCHF is currently at a critical "decision zone" after a period of significant volatility. Following a sharp decline earlier this week, price action is now signaling a potential shift in momentum.

1. Key Support Validation

The pair successfully tested a major support zone near 0.7870 – 0.7880.

GBPJPY Weekly Outlook: Short Retest Before Bullish Push to 216.0GBPJPY shows strong bullish momentum after recent highs around 213.92, but expect a minor short recovery first. Market likely retests support at 210.44 or deeper to 208.00 before resuming uptrend targeting 216.00 next week. Chart highlights key levels with recent price action from ~210.84 lows.

Key

See all forex ideas

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | - |

Trade directly on Supercharts through our supported, fully-verified, and user-reviewed brokers.