TSM | Bullish Scenario After Liquidity Reaction

NYSE:TSM

Bias: Bullish

Price is currently reacting from a liquidity-driven area. If price retraces toward the 340 zone and holds structure, I will look for bullish continuation aligned with higher-timeframe context.

Invalidation: Acceptance below 318 would negate the bullish scenario.

Upsid

Johnson & Johnson extends the uptrend,1 Price has been trending higher for months with repeated, orderly pauses

2 Each consolidation formed at a higher level and resolved to the upside

3 The latest push was steeper, increasing the chance of another pause

4 So far, pauses have looked constructive rather than distributive

5 Silent Flow is

AAPLAAPL | 1D | Aggressive BUY Setup

📌 Buy only above blue line (262.17) on strong close.

🛑 Stop Loss below red line (255.50) to control risk.

🎯 Minimum Target: Green line (275.38); further upside possible if momentum sustains.

📊 Price attempting base formation after decline

📈 RSI near oversold zone,

Brinks company analysisI am going to buy this stock because of following reason.

1. Stock has given good move

2. stock is created good based of 3 weeks long.

3. Stock has broken out with good volumn.

4. Stock has seen consistent growth in last 8 quarters.

5. high financial strength, mid valuation, good momentum score

6. q

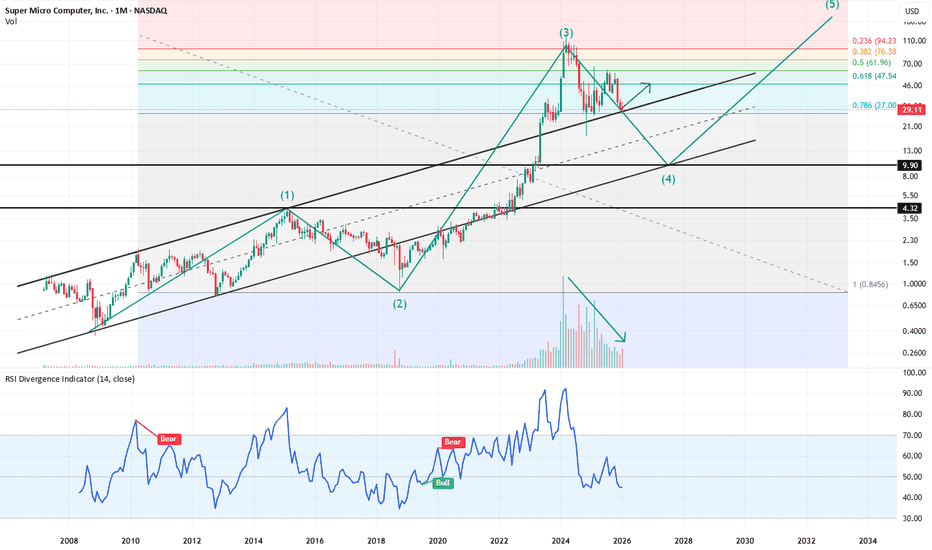

Navigating the Correction and Targeting the Next HurdleSMCI appears to be in the final stages of a significant corrective phase on the monthly and daily charts, following a strong impulse move. This analysis suggests we are working within a larger corrective structure, potentially a flat pattern that began in early 2025

Current Position: The stock pric

Colgate Palmolive Analysis* The primary trend of the stock is bullish, although prices witnessed a bearish retracement for over a year (Sep 2024 - Oct 2025)

* Since strong Q3 earnings (Oct 2025), a bullish pull-back could be seen, and prices rose more than 16.5% in over +3 months

* Recently prices tested fib level 0.618 (

ANET | No Fireworks, Just Higher Prices to 178 target📡 Arista Networks, Inc. (ANET)

Calm Pullback, Serious Business | Bullish Continuation Setup

🧠 Let’s be honest…

Not every stock needs fireworks to make money.

Some just do the work quietly — and ANET is one of them.

After a healthy reset, Arista is back above key value and VWAP, telling us somethi

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activePre-market gainersPre-market losersPre-market most activePre-market gapAfter-hours gainersAfter-hours losersAfter-hours most activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksPink sheetOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Today

EPCEdgewell Personal Care Company

Actual

−0.16

USD

Estimate

−0.16

USD

Today

WATWaters Corporation

Actual

4.53

USD

Estimate

4.51

USD

Today

LLoews Corporation

Actual

2.14

USD

Estimate

—

Today

CNACNA Financial Corporation

Actual

1.16

USD

Estimate

1.29

USD

Today

APOApollo Global Management, Inc. (New)

Actual

2.47

USD

Estimate

2.04

USD

Today

DTDynatrace, Inc.

Actual

0.44

USD

Estimate

0.41

USD

Today

BDXBecton, Dickinson and Company

Actual

2.91

USD

Estimate

2.81

USD

Today

SBHSally Beauty Holdings, Inc. (Name to be changed from Sally Holdings, Inc.)

Actual

0.48

USD

Estimate

0.46

USD

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Electronic Technology | ||||||||

| Technology Services | ||||||||

| Finance | ||||||||

| Health Technology | ||||||||

| Retail Trade | ||||||||

| Producer Manufacturing | ||||||||

| Consumer Non-Durables | ||||||||

| Energy Minerals | ||||||||

| Consumer Durables | ||||||||

| Consumer Services |